Where retirees are moving

Canva

Where retirees are moving

Aerial view of a town in San Antonio.

Fixed incomes can’t go as far for retirees with the current pressures from high inflation and a volatile stock market. For some, relocating to a cheaper or more tax-friendly part of the country may no longer be a matter of preference, but a necessity. Recent data suggests that seniors are moving out of expensive northeastern cities and into other parts of the country.

With this in mind, SmartAsset examined U.S. Census Bureau migration data to uncover where retirees are moving. These cities may be attractive for a multitude of reasons, including community, taxes, recreation, climate and more.

Key Findings

- Retirees are choosing this Arizona city more than any other place. Mesa, Arizona topped the list for the nation’s highest net gain of seniors for the third consecutive time. In fact, the influx of retirees more than doubled that of the second place city.

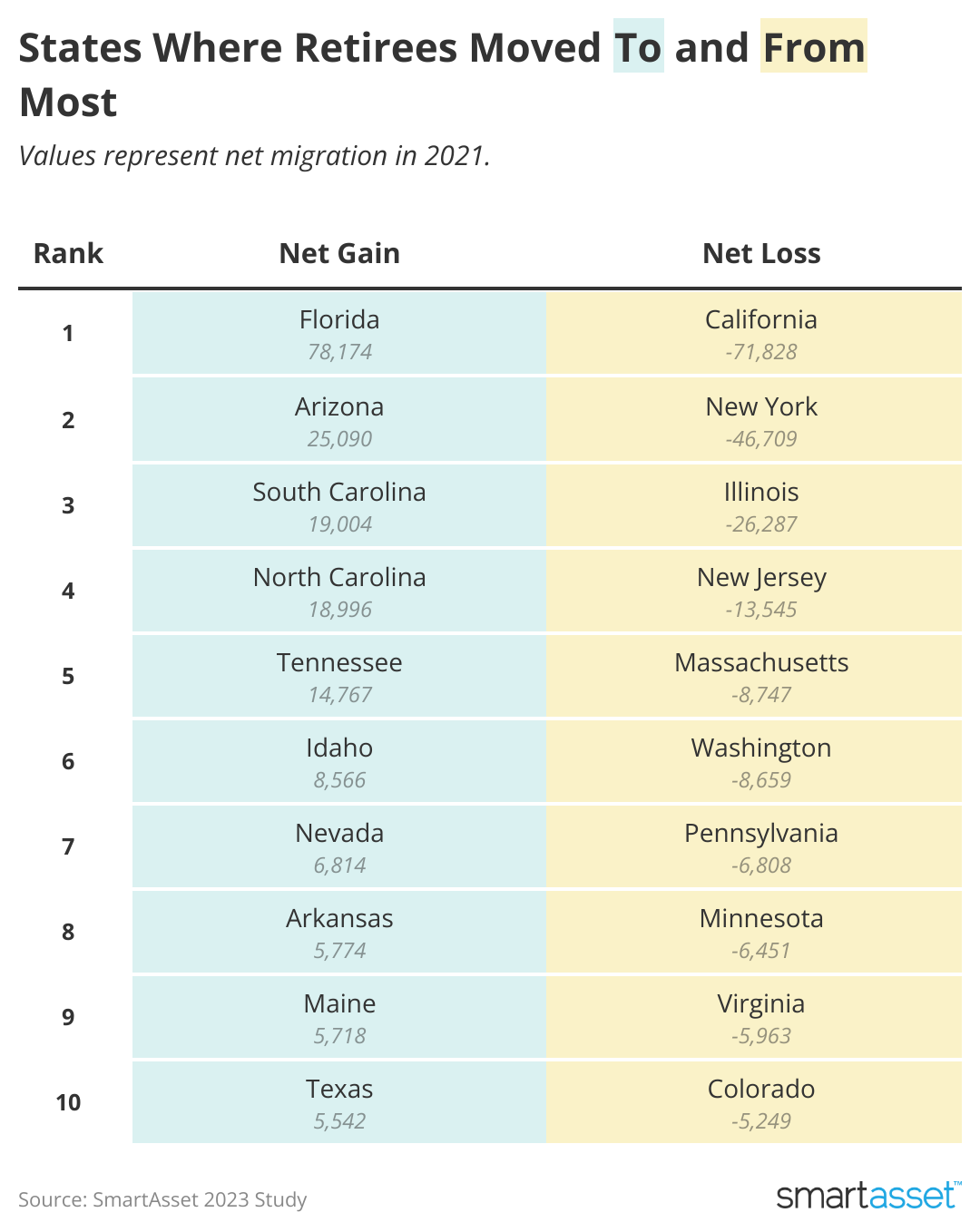

- Florida sees a massive influx of seniors. Florida netted more than 78,000 senior residents from other states in 2021 – three times as many as the second-ranked state. Miami, Jacksonville, St. Petersburg and Tampa all placed among the top 20 cities gaining the most seniors.

- In a dramatic reversal, Charlotte drops more than 100 spots. The North Carolina city fell from No. 6 to No. 130. In last year’s study, Charlotte had a net gain of 1,290 residents 60 and older. But according to the most recent data, 3,150 retirees left Charlotte while only about 1,860 moved to the Queen City from other states.

- Taxes and climate appear to influence retirees. Nevada, Texas and Florida took six of the top 10 spots for where retirees are moving. Coincidentally – or not – these states represent the intersection of warm climates and no state income tax.

![]()

SmartAsset

Heading south

List showing where retirees moved to and from most in 2021.

It’s no surprise that Florida had the nation’s largest net migration of people 60 and older. The Sunshine State attracts tens of thousands of seniors from other states each year, thanks in part to its warm climate and no state income tax. Approximately 54% of seniors who moved into the state in 2021 were in their 60s compared to 46% who were 70 and older.

Four Sun Belt states – Arizona, South Carolina, North Carolina and Tennessee – had the next largest net migrations of people 60 and older. Census data shows that there were net inflows of 25,090 to Arizona and 19,004 to South Carolina in 2021. Meanwhile, North Carolina and Tennessee recorded net migrations of 18,996 and 14,767, respectively.

SmartAsset

Cities where retirees are moving

Map showing the top 10 places where retirees are moving.

1. Mesa, AZ

Mesa welcomed 4,967 new residents age 60 and older from other states in 2021. Meanwhile, only 1,338 people 60 and older left the city that year, resulting in a 3,629 net gain. Of the half million people that call Mesa home, nearly a quarter (24.33%) are 60 and older. The warm, low-humidity climate offers a particular comfort for seniors, and Mesa charges a slightly lower sales tax rate than neighboring Phoenix.

Canva

2. Henderson, NV

Street view of Henderson, Nevada, at night.

The first of four Nevada cities in the top 10, Henderson had a net migration of 1,602 seniors in 2021, in part thanks to Nevada’s lack of state income tax. The 60-plus age group comprises 25.67 of Henderson’s total population (322,202). Retirees enjoy sunshine and warm weather most of the year, and many live in one of Henderson’s large 55+ communities.

Canva

3. San Antonio, TX

Aerial view of a town in San Antonio.

Of the 10 largest cities in the U.S., San Antonio is the only one to crack this study’s top 10. The home of the Alamo had the third-highest net migration of retirees across the study, gaining 1,164 senior residents. The weather, abundance of activities and lack of state income taxes in Texas all contribute to its popularity among retirees.

Canva

4. North Las Vegas, NV

Aerial view of a North Las Vegas town.

Roughly 2,300 seniors moved to North Las Vegas from outside of Nevada in 2021, and only 1,190 moved to another state. Its location in the Mojave desert keeps it warm and dry for much of the year, while downtown Las Vegas offers plenty of entertainment, gambling and dining options.

Canva

5. Boise, ID

Aerial view of a town in Boise, Idaho.

Boise welcomed 2,089 new senior residents in 2021, more than double the number of seniors (991) who left the city for a different state. Boise may attract retirees who prefer mild seasons to a warm climate, and is home to a number of retirement communities.

Canva

6. Wilmington, NC

Aerial view of a neighborhood in Wilmington, North Carolina.

Wilmington, NC was the highest ranking coastal city. In fact, no city in the top 10 has a higher percentage of residents 60 and older than Wilmington, where seniors comprise nearly 27% of the total population. In 2021, subtropical and beachy Wilmington had a net migration of 992 seniors. Wilmington boasts an impressive retention rate of retirees, as only 453 people aged 60 and up left Wilmington for another state – the lowest emigration rate of the top 10.

Canva

7. Frisco, TX

Tree-lined walking path near a lake in Frisco, Texas.

Frisco recorded a net gain of 960 people 60 and older in 2021. More than 1,430 seniors moved to Frisco from another state while 476 left the state of Texas. People 60 and older comprise just 13.16% of Frisco’s population, the lowest percentage of the 10 cities at the top of the rankings. Among other tax benefits for retired Texans, homeowners can reduce their property tax liability via a special homestead exemption.

Canva

8. Miami, FL

Aerial view of a beach in Miami.

While Miami has a particularly high cost of living among the big cities where retirees are moving, it offers plenty of amenities from beaches to entertainment to a variety of retirement communities. The city had a net migration of 947 seniors in 2021. Seniors make up nearly a quarter (24.62%) of Miami’s total population.

Canva

9. Jacksonville, FL

Aerial view of Jacksonville near the ocean.

Jacksonville – like Miami – offers retirees the benefit of no state income tax. That may have helped attract the net 843 new residents aged 60 or higher. Unlike Miami, Jacksonville has a relatively low cost of living compared to the average American city. Beachgoers also have a 30 minute drive between the beaches and downtown.

Canva

10. Raleigh, NC

Aerial view of downtown Raleigh, North Carolina.

Raleigh had an exceptionally low emigration rate, boosting it into the top 10. Only 454 seniors moved out throughout 2021 – one more than from Wilmington, NC. This inland city doesn’t offer any beachfront amenities, but it does offer a relatively low cost of living when it comes to big cities.

SmartAsset

Data & methodology

Table showing the top 20 cities where retirees are moving.

To find both the states and cities where retirees are moving, SmartAsset analyzed data from the Census Bureau’s 2021 1-year American Community Survey.

This study considers the populations aged 60 and older (for this study’s purposes, retirees) in 146 of the largest cities in the U.S. for which data was available. The study similarly found net migration for each city by subtracting the number of retirees who moved out of the city to a different state in 2021 from the number of people aged 60 and older who moved into the city from a different state. Cities with the highest net migration ranked the highest.

Limitations

Some limitations of the data available for this study include:

- The data does not reflect migration within the same state. It only reflects movement from a city in one state to a city in another state. For example, if a person moved to Phoenix from Scottsdale, they would not be factored into the data.

- Some retirees might live in multiple places throughout the year; this is not reflected in the metrics.

- Not all people 60 and older are retirees.

Retirement Planning Tips

- Consider moving to a tax-friendly state. Taxes are an important component of retirement planning. Some retirees end up moving to lower-tax states to maximize their income. Identifying states’ retirement tax friendliness may help you identify where to spend your golden years.

- Avoid retiring in a down market. Retiring in a down market can expose you to what’s called sequence risk. Withdrawing money from your portfolio during a bear market means you’ll lock in investment losses and potentially limit the longevity of your savings.

- Work with a financial expert. A financial advisor can be a valuable resource, especially as you approach retirement age. Advisors can help you decide when to collect Social Security, how much income you’ll need in retirement and more.

This story originally appeared on SmartAsset and has been independently reviewed to meet journalistic standards.