Are Black Americans being locked out of the American dream of homeownership?

Canva

Are Black Americans being locked out of the American dream of homeownership?

Parents with son and daughter hold moving boxes as they stand in a new living room.

Fifty years after Martin Luther King Jr.’s “I Have a Dream” speech, that dream of equality remains far from realized for too many Black Americans. And, according to the latest data, aspects of that dream are actually more elusive than it was during King’s historic March on Washington.

In 1960, it was legal to refuse to sell a house to someone because of their race. Yet there was still more parity between Black and white homeowners at that time than there is today, over 60 years later. The gap between Black and white homeownership rates that year was 27 percentage points. In the first half of 2022, that gap was over 29 percentage points.

To fully appreciate how detrimental the gap is, we have to remember that homeownership in the United States guarantees more than just shelter. According to the Federal Reserve, homeowners have nearly 12 times as much wealth as renters, with an average of $1.1 million compared to renters’ average wealth of just $95,000.

Low rates of homeownership then put Blacks at a disadvantage in terms of overall wealth as well. The fact that such a relatively small percentage of Black families own a home today is an indication of less wealth overall, and less ability to transfer intergenerational wealth to their children. And, of course, equity in a home can provide a financial buffer in an emergency.

There are arguments against the ‘homeownership society‘ that we have pursued since the end of World War II. But, like it or not, we live in a world where owning a home tends to amplify your political voice, strengthen your economic foundation, and provide you with social capital. So if owning a home is a part of the American Dream, why are Black Americans being left out of it?

To understand why, Today’s Homeowner analyzed data from the U.S. Census Bureau on Black and white homeownership rates at the national level from 1994 through the first half of 2022, and at the state and city level from 2010 through 2021. We looked at data from all 50 states and the District of Columbia, and from nearly 300 cities that had figures available from 2010 to 2021. Here’s what we learned.

![]()

Today’s Homeowner

Main Findings

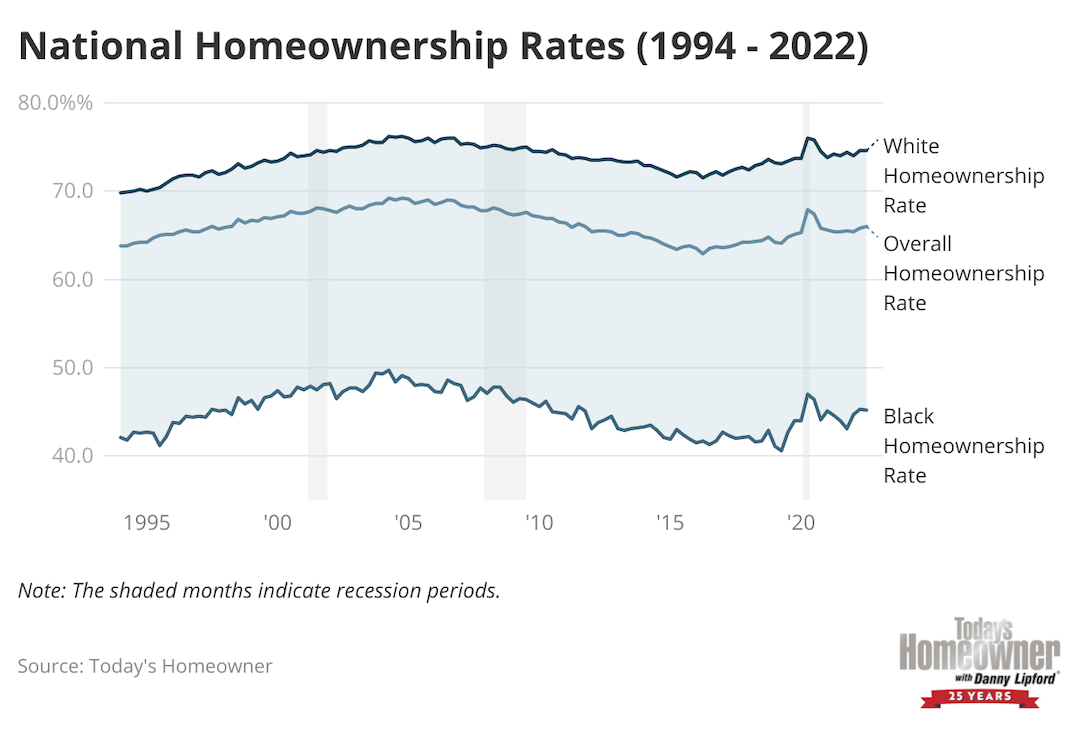

Chart showing how white and Black homeownership rates have changes between 1994 and 2022.

- Since 1994, the gap between Black and white homeownership rates worsened by over two percentage points. Most of this has occurred in the last decade – between 2010 and 2021, the gap grew by 1.5 percentage points.

- 98% of cities still have a gap between Black and white homeownership. Arden-Arcade, CA; Mesa, AZ; Bethlehem, PA; Torrance, CA; and Rochester, MN have the widest gaps.

- A handful of Western cities have gaps in the opposite direction, with higher homeownership rates among Black residents than white ones. They are Santa Ana, Corona, Manteca, Temecula, and Inglewood, CA, and Pueblo, CO.

- States in the South had some of the narrowest gaps, including South Carolina, Georgia, and Alabama. DC has the smallest gap between Black and white homeownership rates at about half of the national average gap.

- Midwestern states had the biggest gaps: North Dakota, South Dakota, Minnesota, and Wisconsin have some of the widest gaps in 2021. However, both Minnesota and South Dakota have improved their gaps since 2010.

- Most states saw the Black-white homeownership gap worsen between 2010 and 2021. Vermont, Hawaii, Alaska, New Mexico, and New Hampshire all saw their gap grow by about 10 percentage points or more.

- Only 15 states narrowed their gap over that time period – the Rocky Mountain states of Idaho, Montana, and Wyoming led the way with double-digit reductions.

Today’s Homeowner

National Black-White Homeownership Gap Widened Over Past 28 Years

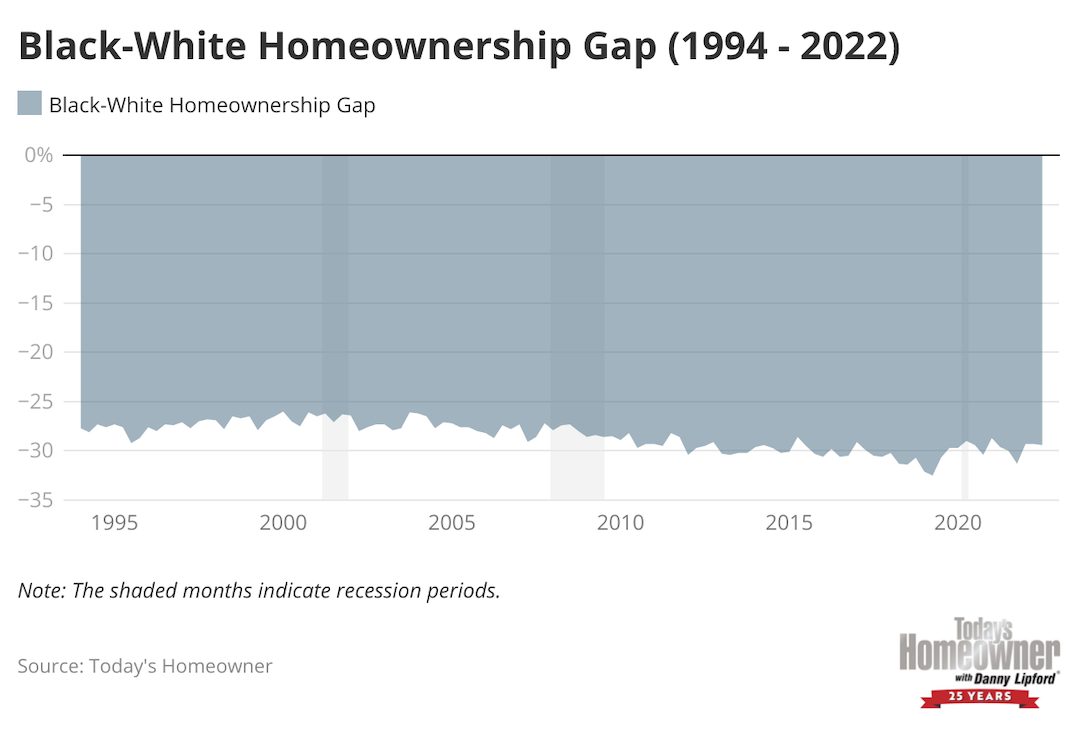

A chart showing how the difference between Black and white homeownership has changed between 1994-2022.

The national gap between Black and white homeownership rates is an important gauge of how we, as a country, have progressed toward the goals of equitable access to homeownership. By that measure, we have backtracked in terms of equality between Black and white families.

Homeownership rates, both overall and for white and Black Americans, have increased since 1994. However, the gap between homeownership rates not only persists, but has grown. In 1960, the gap was 27 percentage points. In 1994, it was slightly higher at 27.7. By July of 2022, the gap had grown to 29.4 percentage points.

The graph above shows that the Black and white homeownership rates do not move in lockstep. By looking specifically at the gap between Black and white homeownership rates, we can get a better idea of how that difference has narrowed and widened over the years.

These reversals are particularly puzzling because policymakers thought they laid the groundwork for future housing equity decades ago with the 1968 Fair Housing Act. Until then, housing discrimination was both widespread and allowed under federal law. But contradictory state laws, uneven enforcement, and ingenious workarounds allowed discriminatory selling and lending practices to continue.

These discriminatory practices may no longer be a matter of policy today, but they still exist. In the past year the Justice Department has reached settlements with lenders in New Jersey, Philadelphia, and Houston over alleged racially-motivated redlining, where lenders markup maps to indicate neighborhoods where they do not want to make loans.

The data also shows that Black homeowners are more vulnerable to economic shocks. During the Great Recession, the white homeownership rate was largely stable at around 75% through 2008 and 2009. The Black homeownership rate, on the other hand, went from 47.7% down to 46% during the same time period. It would continue to drop until reaching its nadir of 40.6% in late 2019.

“Homeownership is often transferred intergenerationally, including through down payment assistance and passing on knowledge. So when many Black Americans lost homes during the Great Recession, it also gave the following generation less access to homeownership,” says Jung Choi, Senior Research Associate at the Urban Institute.

Because homeownership is a major part of most households’ wealth, a widening Black homeownership gap feeds a widening Black wealth gap and vice versa.

“Unless we offer assertive programs to provide redress for what has been done, we have cemented a permanent gap, which represents a gap in family wealth, generational wealth, and opportunity, ” says Mark Alston, chair of the National Association of Real Estate Brokers (NAREB) Political Action Committee.

Today’s Homeowner

South Shows Smallest Black-White Homeownership Gaps

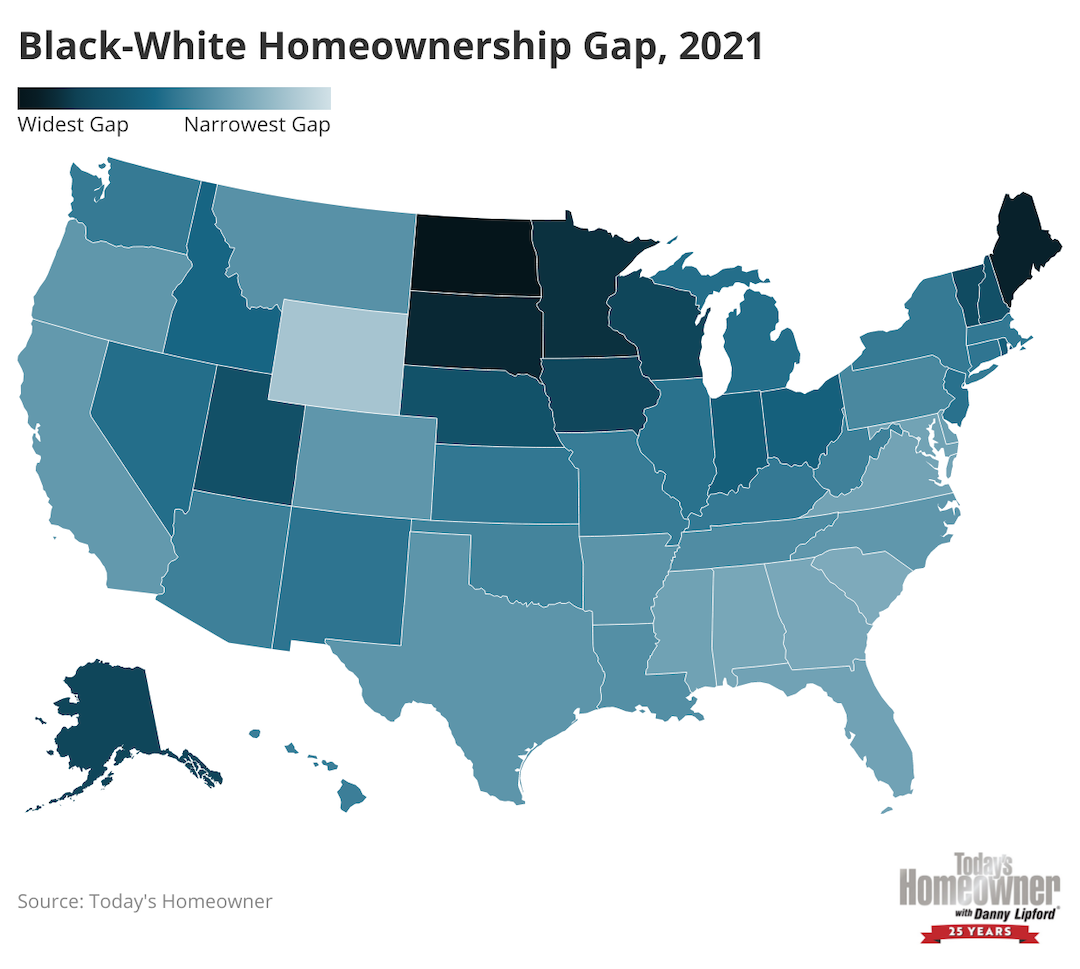

U.S. map showing how states compare by black and white homeownership gaps.

Many of the factors that have historically encouraged or deterred aspiring Black homeowners vary greatly from state to state. For example, while some allowed racially restrictive covenants in property deeds in the 1960s, others codified the right to fair access to housing even before the national government.

In fact, by the time the 1968 Fair Housing Act was signed, 22 states that were home to 41% of the Black population had a fair housing law, according to Vanderbilt economic historian William Collins.

Although housing and lending discrimination is now illegal in all states, there is still significant variation among states in how wide their homeownership gaps are.

Interestingly enough, the states with the widest homeownership gaps are not the ones that were most resistant to the Civil Rights Movement. In fact, many of the states with the worst histories of discrimination, such as those in the South, showed some of the smallest gaps.

“In the South, there are larger Black populations, which often translates to greater political and economic power,” says Alston.

“I have found that Northern liberal states have larger gaps, because discriminatory practices there have always been less overt, making them harder to pin down,” he adds.

The data supports the idea that non-Southern states show greater gaps than other states. The Midwest in particular is overrepresented among states that have the widest Black-white homeownership gaps. North Dakota, Maine, South Dakota, Minnesota, and Wisconsin all have gaps of over 44 percentage points.

The state to come closest to closing the gap isn’t a state, but the District of Columbia, which also happens to have the lowest overall homeownership rate among states. While there is still a gap of about a half a percentage point between Black and white homeownership rates, the nation’s capital is about as equal as homeownership gets in the U.S.

D.C. Mayor Muriel Bowser has made boosting Black homeownership a priority, pledging to swell the ranks of Black homeowners in the district by 200,000 by 2030. The fact that policymakers have made this a marquee issue in the nation’s capital, with the support of D.C.’s voters, provides hope that the district will provide a template for other states to close their homeownership gaps.

Today’s Homeowner

States Show Wide Variation in Progress Toward Closing Homeownership Gap

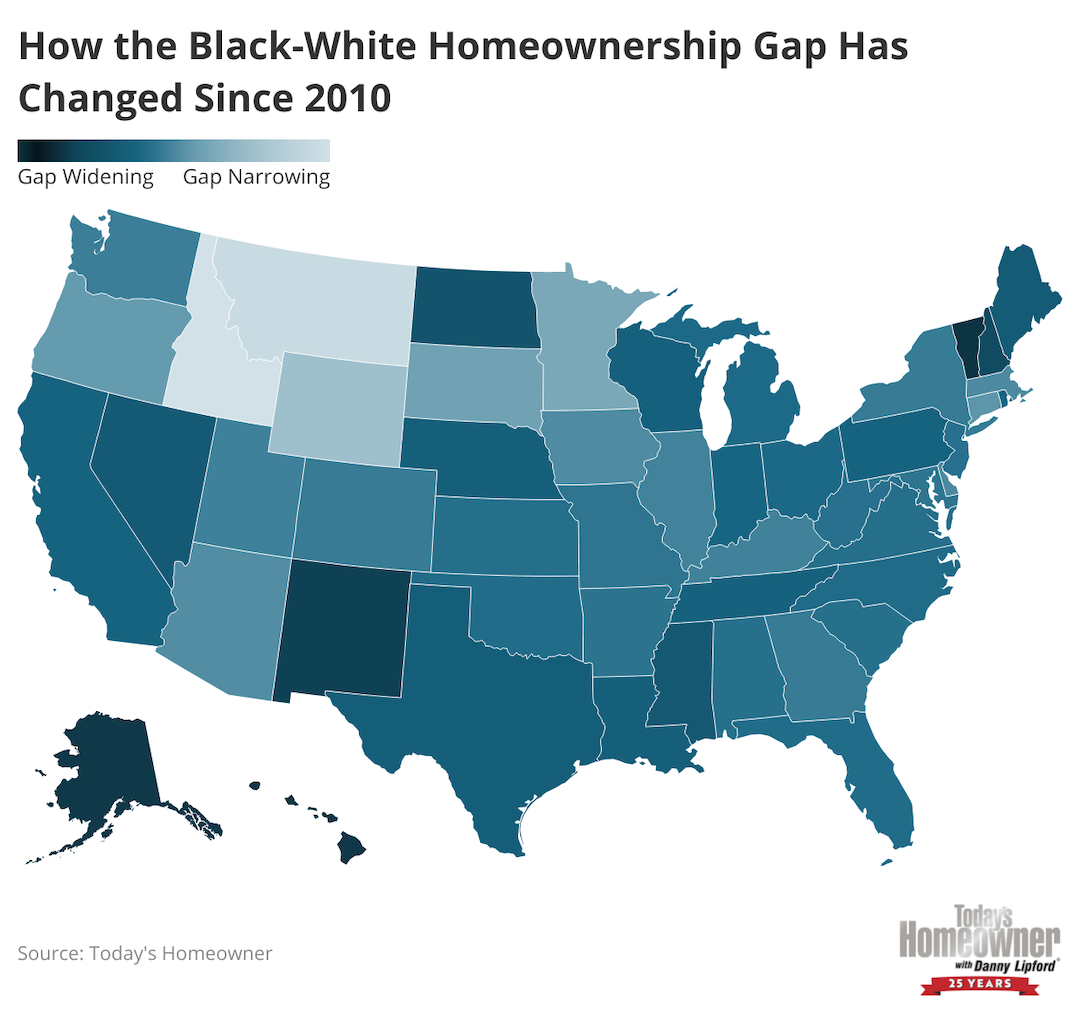

US map showing how states compare by widening and narrowing of white-Black homeownership gap.

With all states showing this gap, the question then becomes which states are making the most progress toward equality between Black and white homeowners?

The Rocky Mountain region showed the most progress on this front, with the top three states all hailing from that part of the country.

Idaho leads the way, with a 21 percentage point decrease in its Black-white homeownership gap between 2010 and 2021. Its Black homeownership rate almost tripled from 13.9% in 2010 to 37.8% in 2021. Meanwhile, the white homeownership rate only ticked up a few percentage points, allowing for that significant progress in closing the gap.

Montana also showed notable progress, shrinking its Black-white gap by 19.2 percentage points in the same period. Only 23.2% of Black Montanans owned their home in 2010, but that share jumped to 41.9% in 2021. The white homeownership rate actually decreased slightly during this period.

The final state that showed a double-digit contraction was Wyoming, which saw its gap go from 31 to 19.9 percentage points. Minnesota and South Dakota rounded out the five best-performing states with decreases of 6 and 4.8 percentage points, respectively.

On the other end of the spectrum are states where the gap has widened. States with double-digit growth in their gaps during this time period include Vermont, Hawaii, Alaska, New Mexico, and New Hampshire.

These substantial variations in Black and white homeownership are “first and foremost” due to the broader affordability crisis and how it is affecting local housing and rental markets, says Nadia Evangelou, Senior Economist and Director of Real Estate Research at the National Association of Realtors (NAR).

If an area lacks affordable rentals and has significant racial income disparities, it is more likely to see a major gap, she says.

“For example, in North Dakota — where the homeownership gap is about 50% — about 30% of white renters can afford to purchase the median-price home, but less than 10% of Black renters can do the same,” Evangelou says.

Choi of the Urban Institute agrees that these supply-side issues such as a lack of affordable housing disproportionately affect the Black population. But she adds that there are also elements of the financial system that tend to weigh on Black demand for mortgages and homes. Many of these are the result of a history where Black Americans were pushed toward predatory lenders, payday loans, subprime mortgages, and other exploitative financial relationships.

“The variables that go into [mortgage] underwriting already show wide disparities that cut against Black applicants. Low or non-existent FICO scores make it difficult to be approved for a mortgage, and poor credit means those mortgages are more expensive and less attractive than renting,” says Choi.

“The long-term solution is about strengthening financial help,” Choi says.

Today’s Homeowner

Handful of Cities Close the Black-White Gap, Most Are Still Struggling

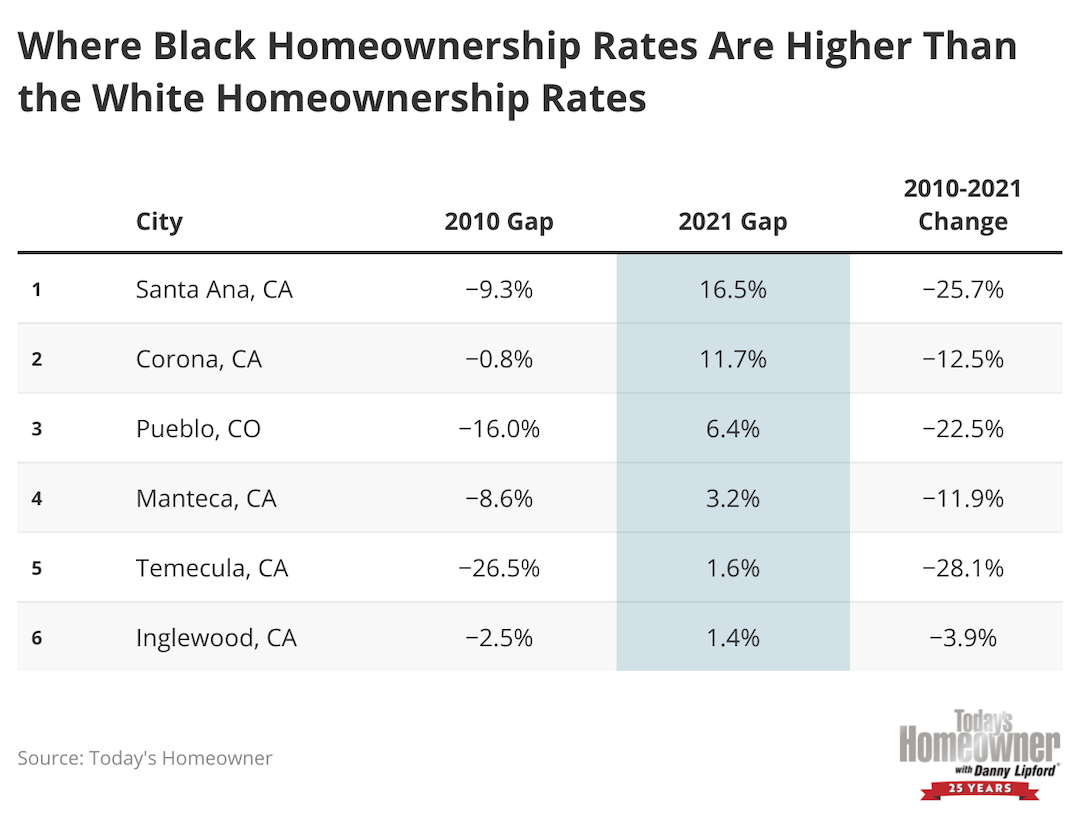

Table showing that the top 6 cities with higher Black ownership rates.

Some of the best news comes from local data, which shows that some cities have closed the Black-white homeownership gap, and others are very close. These results should be considered in the context of each locality’s demographics, though, as some of the top-performing cities have very few Black households.

All of the cities that do not have a gap between Black and white homeownership, or where Black homeownership is higher than that of whites, are located in the Western U.S. They are Santa Ana, Corona, Manteca, Temecula, and Inglewood in California, and Pueblo, Colorado.

For example, Santa Ana has the largest gap in favor of Black households, with a Black homeownership rate of 69.8%, a white homeownership rate of 53.3%, and a 16.5 percentage point gap between the two.

However, the city of over 300,000 only counts about 3,000 Black people in its population. Despite this tiny proportion of Black residents, Black Americans have a rich history in Santa Ana. It was once home to a burgeoning Black population, some of whom came to Orange County for military service nearby. The Black population grew from 433 in 1950 to 8,232 in 1980, but has declined since then. These deep roots may explain the city’s high Black homeownership rate.

Inglewood, in Los Angeles County, has a much larger Black population, of over 44,000, out of an overall population of over 107,000. This has made it one of Southern California’s “last Black enclaves,” and city officials have been determined to keep rising home prices from pricing out longtime Black residents.

According to Census Bureau data, these efforts appear to be working, as Inglewood maintains near-parity between Black and white homeowners. Almost 39% of Black residents owned their home in 2021, while about 37% of white residents were homeowners. However, Inglewood’s Mayor James Butts, suggests that it is difficult to compare these results to data from past years. He notes that recent changes to how the census records race is likely leading to an undercount of the city’s significant Hispanic population, and an overcount of the white population, likely skewing the racial homeownership rates.

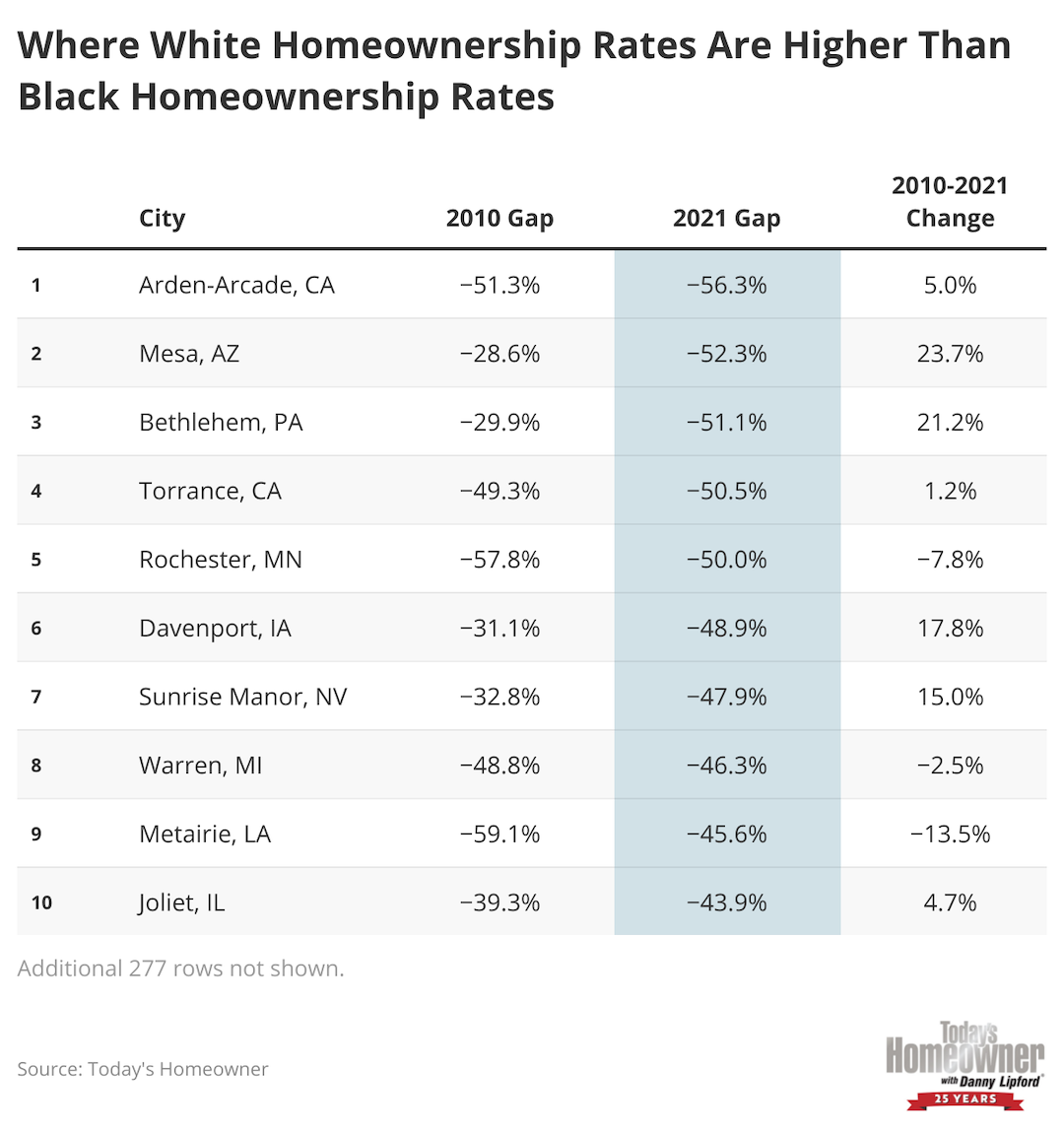

While these partial, conditional success stories are encouraging, the more salient trend we see is that most cities still struggle mightily with this issue and are nowhere close to parity.

Of the 293 cities that had data from 2010 to 2021, 287 of them still reported a gap. However, most have smaller gaps than the national average, which is at almost 30 percentage points.

Five cities have massive Black-white homeownership gaps of 50 percentage points or more: Arden-Arcade and Torrance in California; Mesa, Arizona; Bethlehem, Pennsylvania; and Rochester, Minnesota.

Today’s Homeowner

How Can We Shrink This Gap?

Table showing 10 cities where white homeownerships are higher than Black homeownership..

Policymakers and activists have been trying to boost Black homeownership and increase parity between races for decades. Experts in the field say the Great Recession severely affected Black homeowners at the time, and Black homeowners of the future. But there are prescriptions for remedying this national ailment.

Choi argues we must decrease barriers to access to financing programs for aspiring homeowners. Many of these were erected as safeguards after the subprime mortgage crisis. But many institutions “overcorrected” by instituting such high underwriting standards that mortgages were out of reach for many Black Americans.

She suggests providing targeted down payment assistance programs, Special Credit Purpose Programs (loans focused on economically disadvantaged groups), or otherwise targeting neighborhoods or populations with lower access mortgages.

Choi points out that Chase, Bank of America, and others have these programs in place, with Fannie Mae and Freddie Mac slated to launch similar pilots this year.

The National Association of Realtors offers a multipronged approach to addressing homeownership inequality that overlaps with many of the recommendations from the Urban Institute.

First, we must address the housing supply crisis that is driving prices up and out of reach for Black families, NAR says. Freddie Mac data shows a 4 million unit shortfall of household supply amid a growing population. According to NAR, only 22% of Black Americans can currently afford to buy the median priced home.

NAR notes that “most policies governing housing supply come down to local decisions on zoning and land use.” The organization is ‘pressing for federal incentives for localities to engage in zoning reform.

Second, we must expand access to mortgage credit and tackle the three biggest barriers Black Americans face: credit score, debt-to-income ratio and down payment.

“Black Americans are two times more likely than White Americans to be rejected for a mortgage.

Our housing finance system should be examined and updated to ensure it is serving the credit needs of all Americans,” NAR says.

Some of NAR’s proposed solutions include supporting alternative methods of credit scoring that capture “credit thin” or “credit invisible” consumers by including positive rental history and on-time utility payments. Like the Urban Institute, NAR also supports targeted down payment and credit assistance programs. These programs, which are gaining traction among commercial and government lenders, help consumers overcome a lack of generational wealth caused by historic discrimination, NAR says.

Finally, NAR says it advocates for fair housing enforcement and has invested in fair housing training for its members.

The spotlight on homeownership inequality has intensified due to recent, high-profile headlines concerning racial injustices, according to the Urban Institute.

“We’ve gotten a lot of requests since George Floyd – at the federal, state, and local levels – for research and evaluations into policies about how to [close this gap]. There is definitely more interest, and In that sense there is more positive movement,” says Choi.

Canva

Conclusion

Parents, son, and daughter stand in front of a new home.

However we slice the data, we find that there are gaps between Black and white homeownership. This trend has held true at the national, state, and local levels for decades now. But just because this gap has persisted – from the Civil Rights Movement through the subsequent economic booms of later decades – doesn’t mean we should accept it as a permanent fixture of our society.

As our data has shown, the country is moving further away from – not closer to – equality between Black and white homeowners. Just as the Great Recession over a decade ago hobbled Black homeownership rates for years to come, there are concerns the pandemic-induced economic uncertainty of today will have similar repercussions.

Recent homeownership rates peaked for both Black and white Americans in early 2020, and then fell in the immediate aftermath of the pandemic. But while the white rate dropped slightly and stabilized in the following months, and the overall homeownership rate actually improved in 2022, the Black rate fell further and stayed down longer. Perhaps most worryingly, the Black homeownership rate has actually shown a downward trend for the first half of 2022.

Compared to past decades, state and federal authorities are taking a more aggressive approach to enforcing the fair housing laws that have been on the books for almost half a century. However, this case-by-case approach fails to take into account the urgent need to redress past wrongs, as well as to ensure Black families today are able to pass the benefits of homeownership on to future generations.

As we’ve outlined, the gap between Black and white homeownership rates has real and detrimental impacts on racial equality and wealth creation, and those effects cascade through generations.

“It wasn’t that Blacks didn’t or don’t want to buy houses. This inequity was created over time due to intentional opposition, supported by discriminatory laws and traditions,” emphasizes Alston of NAREB.

Although discriminatory laws have been banned, the data from our study shows that we still haven’t figured out how to close the gap between Black and white homeowners. In order to do so, we need to be as intentional in tearing down the barriers to homeownership as our forebears were in putting them up.

Methodology

To calculate the Black-white homeownership gap, we subtracted the Black homeownership rate from the white homeownership rate. A positive value for the gap indicates that the Black homeownership rate is greater than the white homeownership rate. A negative value for the gap indicates that the white homeownership rate exceeds the Black homeownership rate.

These calculations were based on national, state, and city-level data on owner-occupied households from the Census Bureau’s American Communities Survey. In total, we compared all 50 states along with the District of Columbia and 293 cities with available data.

This story originally appeared on Today’s Homeowner and has been independently reviewed to meet journalistic standards.