Biden administration argues it should be allowed to carry out student debt relief plan as appeal plays out

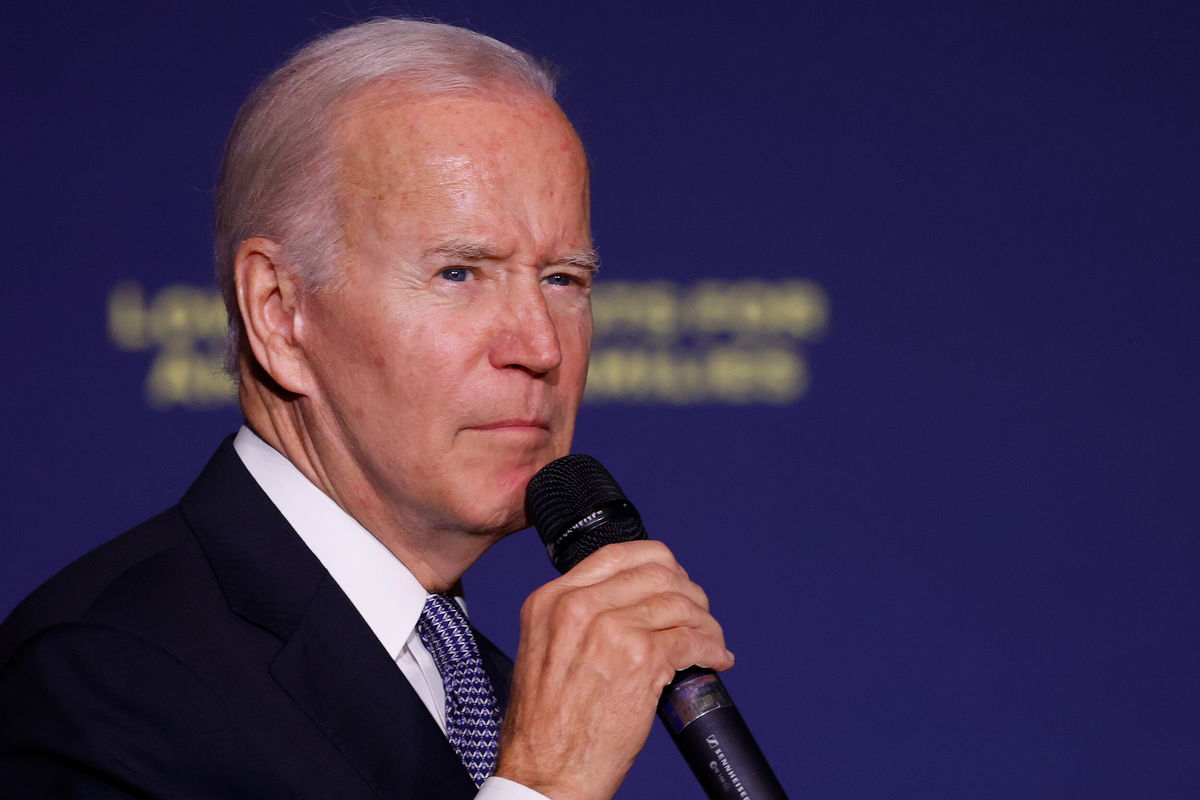

President Joe Biden gives remarks on student debt relief at Delaware State University on October 21. The Justice Department told an appeals court on October 24 that the Biden administration should be allowed to carry out its student debt relief plan as an appeal plays out.

By Tierney Sneed

The Justice Department told an appeals court Monday that the Biden administration should be allowed to carry out its student debt relief program while litigation over the policy plays out.

In a new brief filed with the 8th US Circuit Court of Appeals, which is considering a challenge to the program brought by six Republican-led states, the administration defended the policy while arguing that there were serious procedural flaws with the challengers’ case.

The Justice Department said the challenge is “based on speculation about possible downstream economic effects.”

A district court threw out the Republican states’ case last week, finding that the states had not shown that they’ll suffer direct harm from the policy that would warrant a judicial intervention. After an appeal from the challengers, the 8th Circuit on Friday put an administrative hold on the policy, barring the Biden administration from canceling any loans under the program while the appeals court considered the states’ emergency request that the court get involved.

In its brief Monday, the Justice Department wrote that US Secretary of Education Miguel Cardona acted in his authority in rolling out the policy, telling the court that the “Secretary reasonably deemed it necessary to exercise his HEROES Act authority to prevent pandemic-induced harm to lower-income student-loan borrowers.”

“Congress hardly could have expressed more clearly its intent to give the Secretary maximum flexibility to ensure borrowers are not worse off financially because of a national emergency, and the Secretary complied with the Act’s plain terms, ” the DOJ wrote.

Following the ruling, the White House and Cardona encouraged borrowers to still apply for relief despite the hold, with Cardona pledging Saturday to keep “moving full speed ahead” on plans to implement the debt relief program.

A reply from the GOP-led states is due Tuesday.

The Biden administration is also facing lawsuits from Arizona Attorney General Mark Brnovich, and conservative groups such as the Job Creators Network Foundation and the Cato Institute.

Many of the legal challenges claim that the Biden administration does not have the legal authority to broadly cancel student loan debt.

Biden’s student loan forgiveness program, first announced in August, aims to deliver debt relief to millions of borrowers before federal student loan payments resume in January after a nearly three-year, pandemic-related pause.

Under Biden’s plan, eligible individual borrowers who earned less than $125,000 in either 2020 or 2021 and married couples or heads of households who made less than $250,000 annually in those years will see up to $10,000 of their federal student loan debt forgiven.

If a qualifying borrower also received a federal Pell grant while enrolled in college, the individual is eligible for up to $20,000 of debt forgiveness.

The-CNN-Wire

™ & © 2022 Cable News Network, Inc., a Warner Bros. Discovery Company. All rights reserved.