Which states penalize drivers with poor credit the most?

Canva

Which states penalize drivers with poor credit the most?

Several lanes of cars backed up on a highway.

Your credit score is a factor in determining your car insurance rates in nearly every state; however, even in the four states that outright ban the use of credit scores in insurance pricing, some poor credit drivers are still penalized with significantly higher premiums.

MoneyGeek analyzed 2023 national premium data from Quadrant Information Services to explore how having poor credit impacts auto insurance premiums in every state. The analysis found that, despite Michigan banning the use of credit scores in insurance pricing, drivers with poor credit there still see the most expensive auto rates in the nation. The study also found that New Hampshire had the most affordable car insurance for drivers with bad credit. Additionally, the study determined the best insurers for people with poor credit to help these drivers secure affordable coverage options.

![]()

MoneyGeek

Key findings

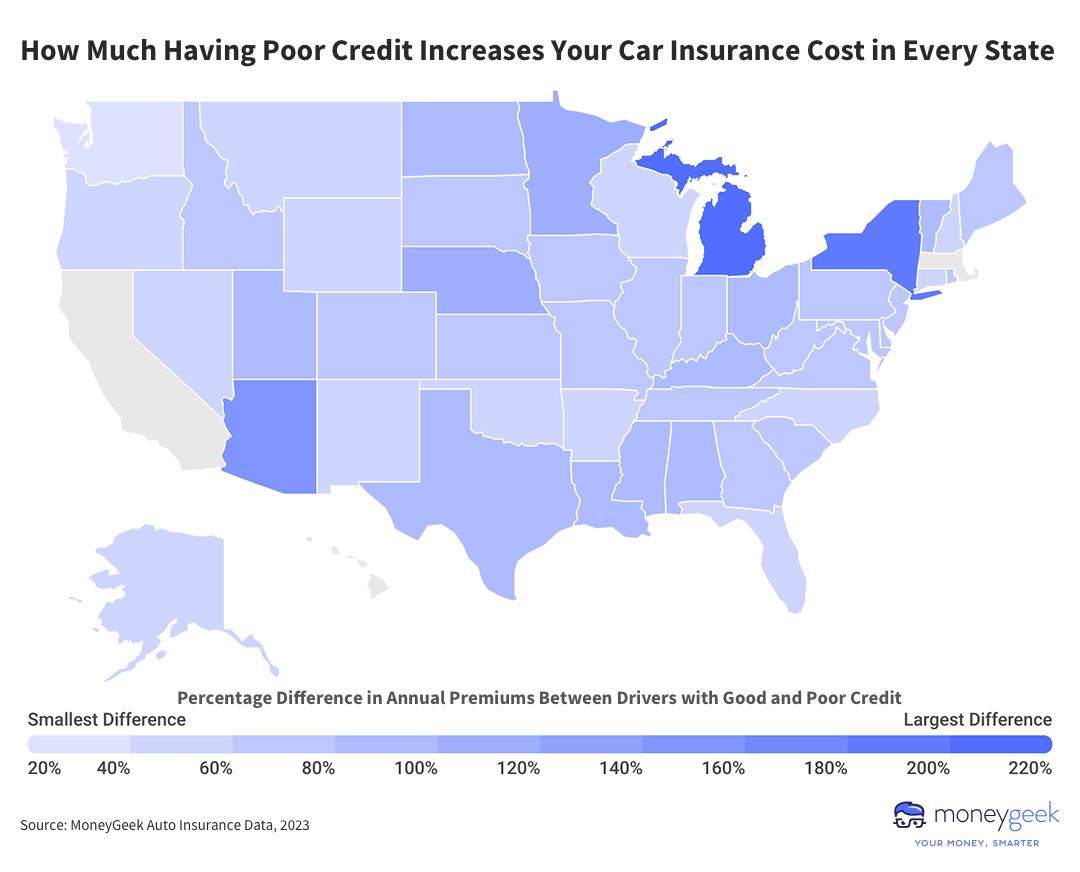

Map showing how much having poor credit increases your car insurance cost in every state.

- U.S. drivers with poor credit pay 79% — or $867 — more for annual premiums for full coverage insurance than drivers with good credit, on average.

- Michigan imposes the heftiest premium increase for drivers with poor credit scores — 225.8% or $3,585 more annually — than drivers with high credit scores. There, poor credit drivers pay the country’s most expensive annual car insurance premiums — $5,172.

- New Hampshire offers drivers with poor credit the most affordable coverage in the country at $996 annually.

- By raising their credit scores by 51 points to the next highest credit rating, drivers with poor credit could save 21% or $527 annually on auto insurance.

MoneyGeek

States With Biggest Differences in Auto Insurance Rates for Drivers with Poor and Good Credit

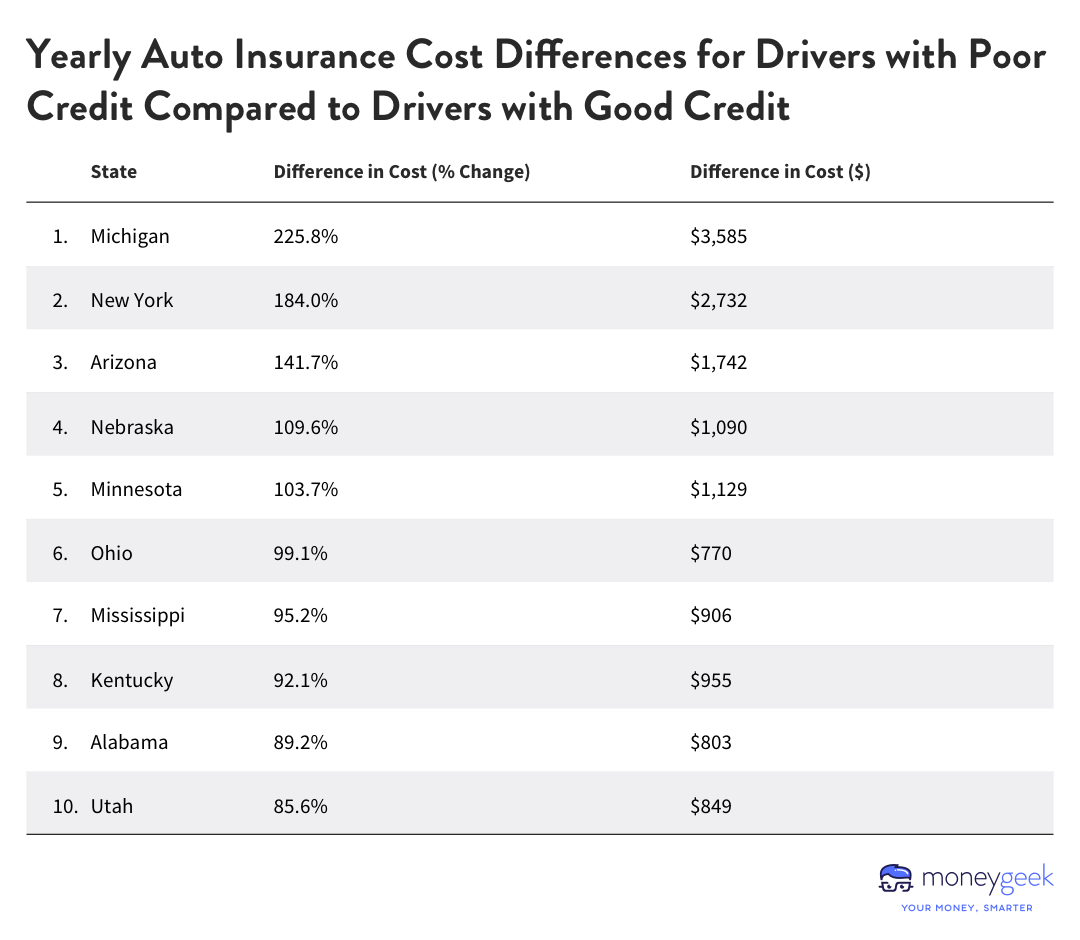

Table showing yearly auto insurance cost differences for drivers with poor credit compared to drivers with good credit.

As part of the analysis, MoneyGeek calculated how much auto insurance annual premiums increased for drivers with poor credit in every state. It found that drivers with poor credit pay an average of 79% — or $867 more — per year for full coverage car insurance than drivers with good credit.

The study also found that the difference in insurance costs for drivers with poor credit in 14 states is higher than the national average. For example, drivers with poor credit scores living in Michigan, New York, Arizona, Nebraska and Minnesota pay more than twice as much for their car insurance than drivers with higher credit ratings.

MoneyGeek

States With the Highest Auto Insurance Costs for Drivers with Poor Credit

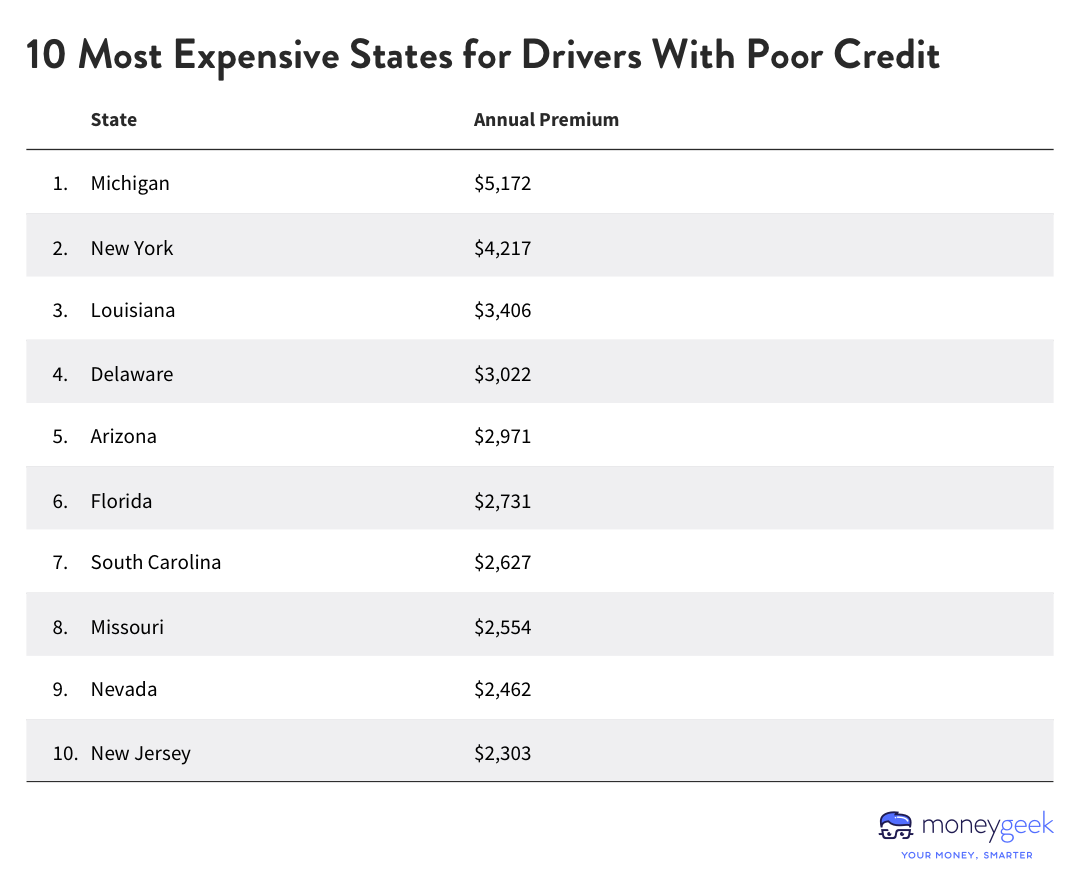

Table showing 10 most expensive states for drivers with poor credit.

In addition to finding the states where the difference in premiums for drivers with good and poor credit is the highest, the study determined the states where car insurance prices are highest overall for drivers with poor credit.

Michigan drivers with poor credit scores face the most expensive auto rates in the U.S., paying $5,172 annually. New York drivers were close behind, with the average provider charging drivers with poor credit $4,217 per year for insurance coverage, followed by Louisiana ($3,406).

While Delaware didn’t make it onto the list of states with the biggest differences between insurance rates for drivers with good and poor credit, it was the fourth most expensive state overall for drivers with poor credit ($3,022).

MoneyGeek

States With the Lowest Auto Insurance Costs for Drivers With Poor Credit

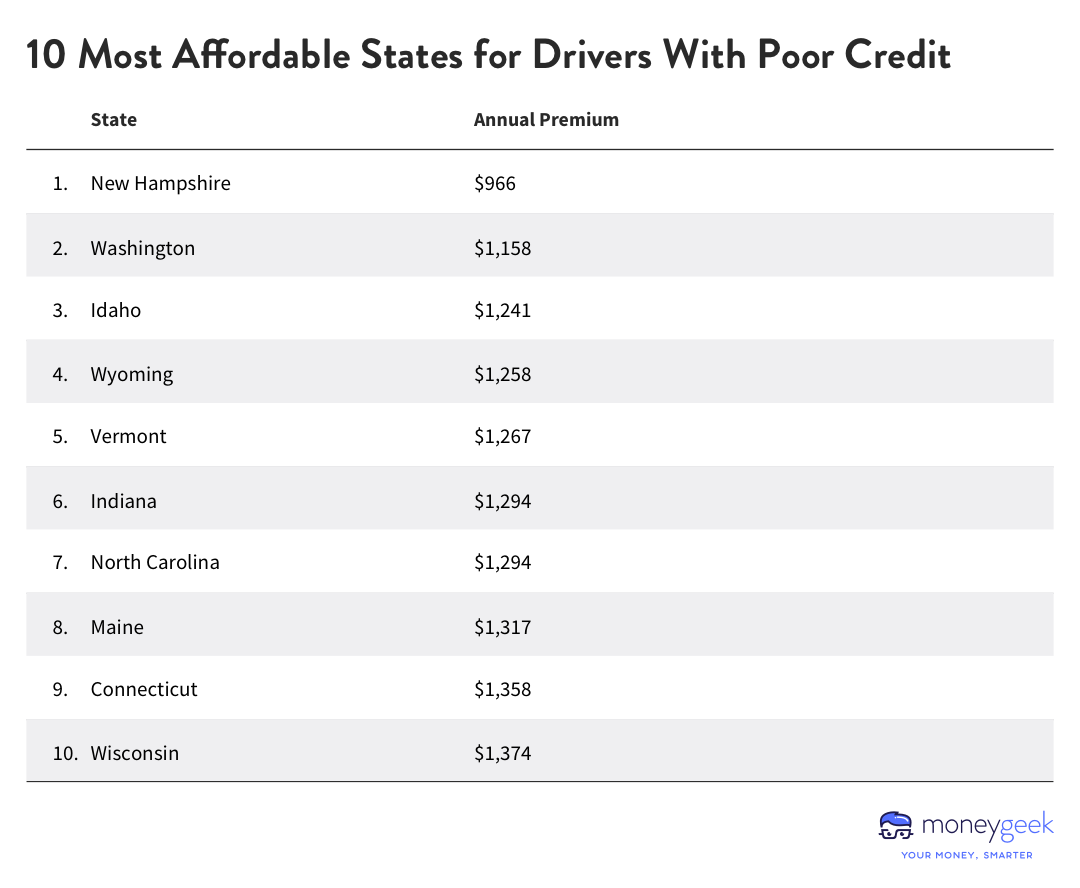

Table showing 10 most affordable states for drivers with poor credit.

While some states charge residents with poor credit scores significantly higher premiums for car insurance, others offer more affordable rates. The study found that, on average, New Hampshire, Washington, Idaho, Wyoming and Vermont charge the cheapest annual auto insurance rates for drivers with poor credit.

Canva

Low-Income Drivers Are Likely Paying the Highest Auto Premiums

A person wearing a yellow sweater examines their credit score on their phone.

Insurance companies’ use of credit scores to determine car insurance rates isn’t just inconvenient: it presents significant opportunities for discrimination. The Federal Reserve Bank of New York found that having a low income is highly correlated with having a low credit score, meaning that drivers with the smallest car insurance budgets often pay the highest auto insurance costs.

“Someone without a credit history, for example, could be priced out of auto insurance, which can impact their ability to work, which in turn means they aren’t able to build credit,” said Gates Little, CEO of altLine, a lending branch of The Southern Bank Company.

“This disproportionately targets immigrants and lower-income individuals despite impeccable driving records and can keep people in a cycle of poverty through outrageous premiums,” Little continued. “This is such a problem that four states have prohibited the use of credit scores in determining insurance rates.”

However, consumers don’t enjoy full protection in all four of these states. Despite the fact that Michigan law prohibits insurers from using credit scores to determine rates, insurers can still use an insurance score that uses elements of credit history; MoneyGeek’s study found that drivers with poor credit in Michigan paid the highest premiums of any state in the country.

Canva

Steps You Can Take to Lower Your Car Insurance Costs

An insurance agent getting a signature for a damaged car.

The fact is that, even in states with regulations, getting car insurance with poor credit can be incredibly difficult. Fortunately, there are some measures consumers can take to find cheaper car insurance rates:

Shop around.

Compare quotes with the same coverage, limits and deductibles from at least three auto insurance companies every six months. While this process can be time-consuming, it helps ensure you get the most competitive rates available for your driver profile.

Find the cheapest coverage for your car’s make and model.

Each vehicle type has different repair costs, safety features and other factors that can affect your total auto insurance premium. Comparing quotes from various providers to find the cheapest auto insurance company for your car’s make and model could help you save significantly on your premiums.

Consider telematics.

If you practice safe driving habits, another potential savings solution is telematics insurance, which rewards drivers for being safe behind the wheel.

Reexamine your insurance coverages.

If your current auto insurance policy includes more than your state’s minimum required car insurance limits, you might be able to get rid of unnecessary coverages or increase your deductible to lower your insurance premium.

Take steps to improve your credit score.

Increasing your credit score takes time and can be particularly difficult if you’re already financially struggling; however, there are small steps you can take to improve your credit, even while experiencing poverty. These small improvements in your credit score can go a long way in decreasing your auto insurance premiums. MoneyGeek found that improving your credit score by as little as 51 points can have an impressive impact on your rates, potentially lowering your premium by $527 per year.

When possible, keeping low balances on credit cards, ensuring there are no errors on your credit report and utilizing older accounts — rather than opening new ones — are just a few things you can do to improve your credit score. It may also be helpful to seek free credit counseling and financial education from nonprofits that belong to the Financial Counseling Association of America or the National Foundation for Credit Counseling.

Canva

Methodology

Cars lined up on a highway.

MoneyGeek analyzed 2023 auto insurance premium data from Quadrant Information Services by state, provider and credit score rating to determine average auto premiums for drivers with “Good” credit scores (769–794) and “Poor” credit scores (524–577).

The study collected data on full-coverage policies at the most common liability level: 100/300/100 for a 40-year-old male driver with a 2012 Toyota Camry LE.

MoneyGeek calculated the difference in these premiums by state to find the states where having a poor credit score affects auto rates the most. The study also analyzed the average savings on premiums between drivers with “Poor” credit ratings and the next rating level — “Below Fair,” which is 51 points higher than “Poor” — to estimate savings upon improving credit scores to the Below Fair rating tier.

California, Hawaii and Massachusetts were excluded from the analysis, as these states prohibit auto insurance providers from assessing rates based on credit scores. Though Michigan law prohibits insurers from using credit scores to determine rates, insurers can still use an insurance score that uses elements of credit history to determine rates. Michigan was included in the analysis, as significant price differences were found between drivers with Good and Poor credit.

This story originally appeared on MoneyGeek and has been independently reviewed to meet journalistic standards.