New companies have nearly doubled Small Business Administration borrowing since 2020

giggsy25 // Shutterstock

New companies have nearly doubled Small Business Administration borrowing since 2020

Hands turning an open sign on glass door.

The first two years can make or break a business.

About 75% to 85% of companies typically make it through their first year. If they succeed for that long, their survival rates tend to rise with each passing year.

As startups ramp up operations and start building a customer base, funding is one of the largest factors determining whether they remain afloat. The Census Bureau’s Annual Business Survey data shows about 11% of small businesses that requested credit in 2020—not including COVID-19-pandemic-specific programs—were denied. And about 1 in 4 received some, but not all, of the credit they requested.

Early-stage companies are most acutely at the mercy of venture capital market changes. Commercial lending for small, young companies is complex and often poses higher credit risks that some commercial banks may not be willing to take on.

The Small Business Administration backs certain loans for small companies and startups to alleviate that risk. While SBA programs don’t guarantee individual small businesses will receive loans, they do expand the options.

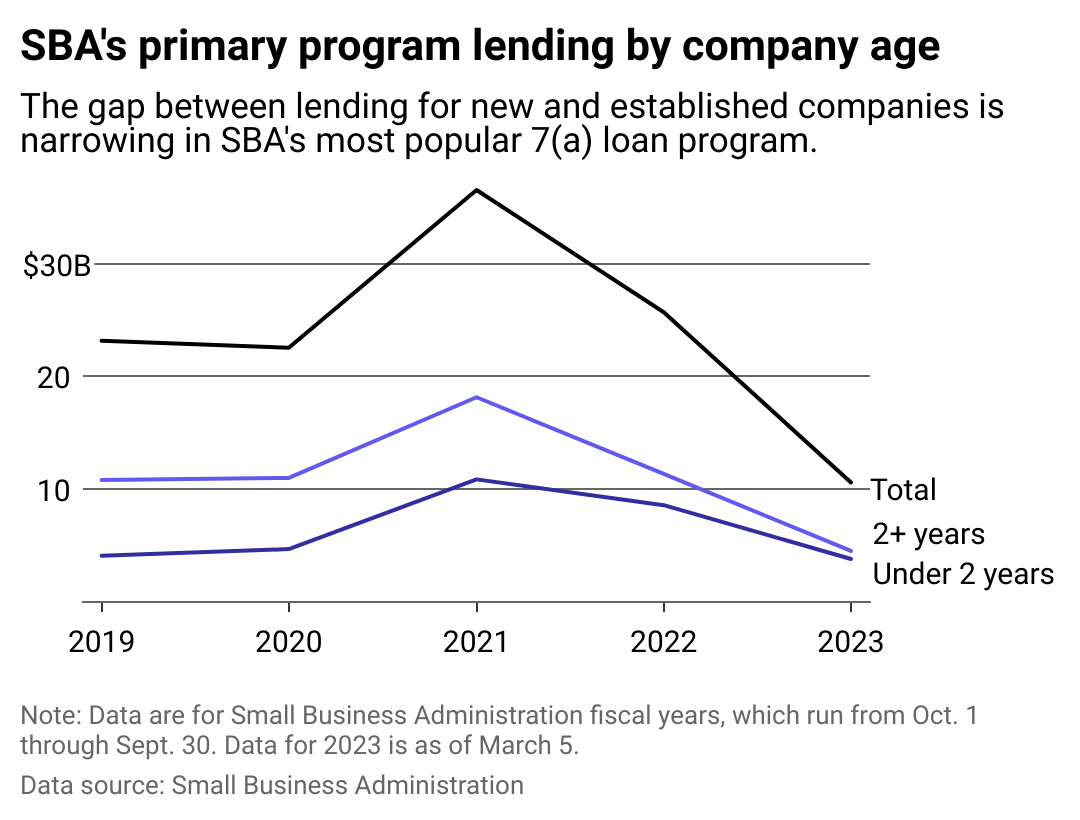

SBA’s 7(a) loan program is its most popular, providing up to $5 million each to applicants for real estate, working capital, supplies, ownership changes, and other company costs. The agency lent a record $44.8 billion to small businesses through traditional loans in the fiscal year 2021, including $36.5 billion in 7(a) loans. Lending slowed since then. So far, in the fiscal year 2023, which began in October 2022, SBA has approved about $11.5 billion for small businesses through the 7(a) program.

Over half of those dollars tend to go to businesses that have been established for more than two years or those changing ownership. But companies in their early days have been growing their share of the pie in recent years, striving to be among the ones that survive. Using information from the Small Business Administration 7(a) lending data, altLINE took a closer look at lending to startups and young companies since 2019.

![]()

altLINE

Small Business Administration-backed loans grew rapidly in 2021

Line chart showing SBA’s primary program lending by company age.

Lending rose in 2021 across all company sizes as some companies struggled to survive the pandemic, and a record number of new businesses made their debuts. In 2022, as many pandemic-related worries began to ease, lending dropped by about 30%, but the agency still approved $25.7 billion in 7(a) loans.

Importantly, lending in 2022 was still about 14% above 2020, showing that at least some of the growth continued.

What’s more, much of that growth can be attributed to companies under 2 years old, which increased SBA 7(a) borrowing by 83% from 2020 to 2022. Companies over 2 years old saw just 3% growth in that time.

altLINE

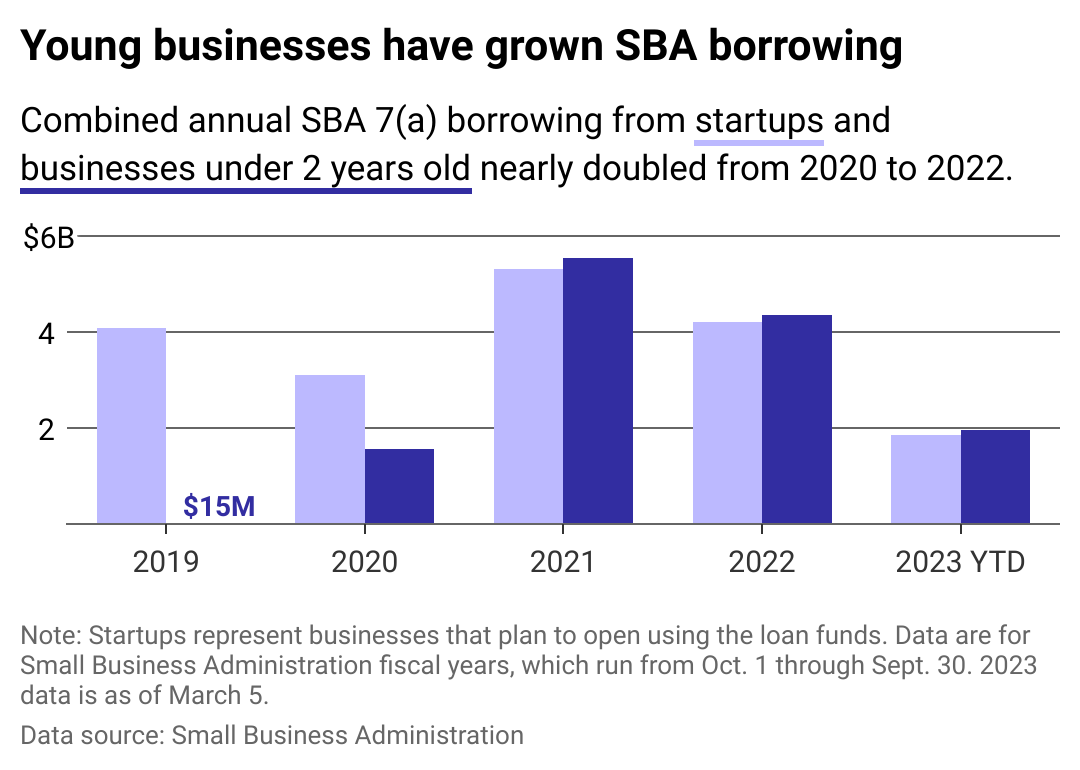

Young companies: A closer look

Bar chart showing how businesses have grown SBA borrowing.

The SBA further breaks down lending by companies under 2 years old, looking at existing companies and startups that intend to use the loan funds to launch their operations. Startups represented most of the borrowing in earlier years of the data, while companies under 2 years old only began to surpass them in 2021.

These early-stage companies may have more trouble accessing grants and loans than established companies because they lack extensive financial statements and credit histories. But they also have the potential to bring something new to the nation’s economy and add jobs over time if they survive those early years. The increasing 7(a) loans support more new companies in configuring offices and storefronts, purchasing inventories, and hiring the personnel that will factor into whether or not they make it.

It’s important to note that in 2019 and 2020, many company ages were represented as “unknown” in SBA’s data. Nearly 12% of company ages were unknown in the 2019 data and 5% in the 2020 data. But by 2022 SBA was able to report the ages of nearly all companies that borrowed funds. It’s likely that existing companies under 2 years old were overrepresented in the unknown sample, so some of their recorded growth could simply be a result of proper identification.

altLINE

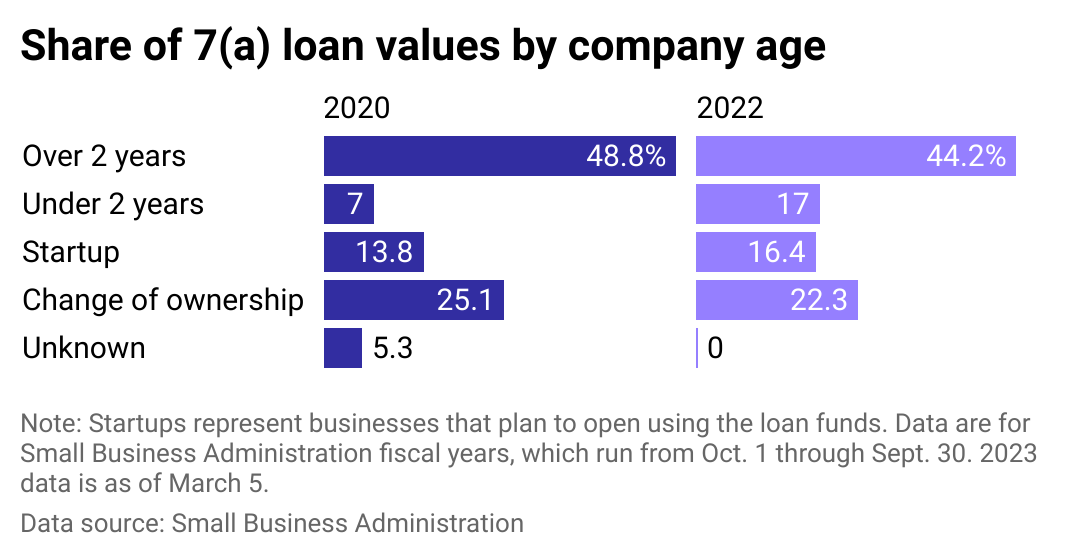

Young companies have grown their share of overall 7(a) lending the most

Chart showing share of loan values by company age.

While growing their borrowing volume, startups and companies under 2 years old have grown their share of overall 7(a) borrowing, as well. So far in 2023, they aren’t backing down, each comprising about 18% of borrowing in the program.

Companies older than 2 years maintain the highest share of 7(a) loan dollars, despite the fact that their loan growth has tapered, and their share has declined slightly. Existing companies changing ownership make up the second-largest share, but that has also declined.

Longer-lasting companies tend to employ more people, according to Census Bureau data. Loan funding allows them to expand business operations or acquire other companies, often adding personnel or keeping people employed.

This story originally appeared on altLINE and was produced and

distributed in partnership with Stacker Studio.