These regions have the most incoming venture capital

Canva

These regions have the most incoming venture capital

Businesswoman talks with colleagues during virtual meeting.

Venture capital investment set showstopping records in 2021. Data from the PitchBook-NVCA Venture Monitor shows venture capitalists invested $341.5 billion in U.S. companies—more than double the 2020 amount, which was also a record year for VC.

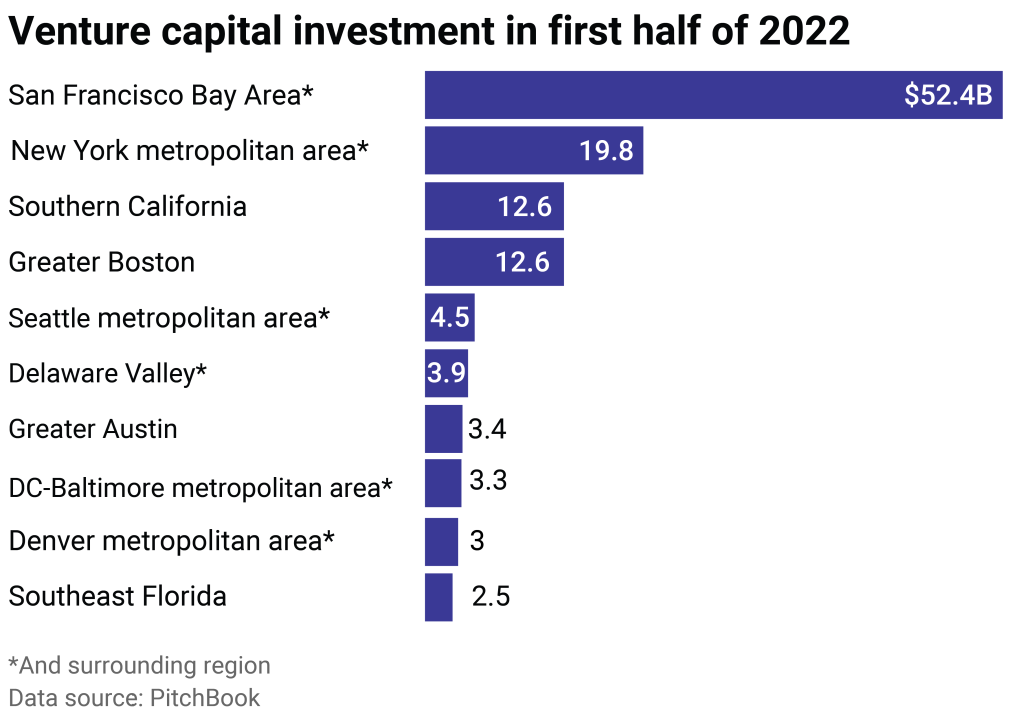

U.S. startup investing is primarily concentrated in 10 regions. ScOp analyzed PitchBook data to look further into trends in VC investing across those areas over the first half, or H1, of 2022 and the years leading up to it. These 10 regions are combined statistical areas as defined by the Census Bureau, with the exception of Greater Austin (which is a metropolitan statistical area).

Deal sizes and valuations grew fast. In a roundup of 2021 data, PitchBook analyst Cameron Stanfill said incoming investment from corporate venture capitalists and other nontraditional investors drove the growth. Deals also happened faster through virtual meetings, with companies raising funds more often through expedited due diligence.

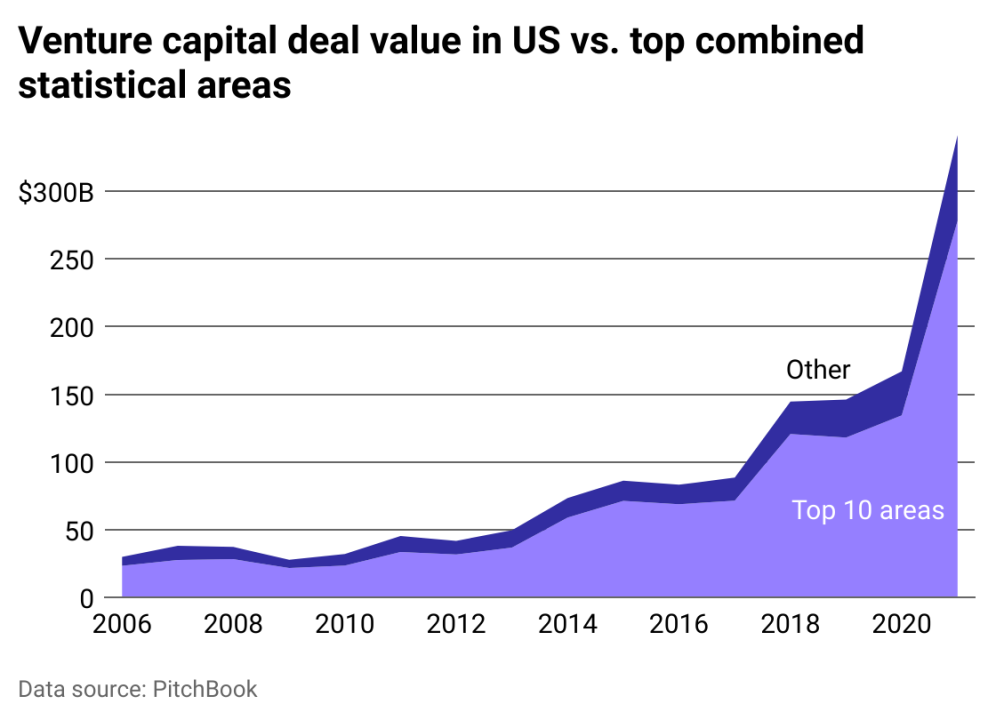

So far, 2022 hasn’t been as explosive, but VC activity is still outperforming the years prior to 2021. Startups raised $144.2 billion as of June 30, compared to $158.2 billion raised in the first half of 2021. That still marks a huge increase over $75 billion raised in H1 2020 and $75.4 billion in H1 2019.

Seed-stage investments were particularly strong in Q2 2022, according to the Venture Monitor report summary. Later-stage companies have had to lower expectations amid the stock market drops, which affect their ability to IPO or to determine prices for private funding rounds.

![]()

ScOp

Top 10 combined statistical areas for VC investment

The top 10 regions for venture capital investment this year are hubs for technology and other major industries.

As the preeminent leader of the U.S. tech industry, it’s no surprise that the San Francisco Bay Area led the way for VC investment in H1. More than a third of VC invested was in this region, according to PitchBook data. Home to industry leaders like Facebook, Google, and Apple, the Bay Area attracts high-tech talent, some of whom branch off to pursue their own ideas and launch new companies. The San Francisco Bay Area is also home to huge venture capital firms, including Y Combinator, which funded more than 200 deals in the region in 2021.

Some of the top Bay Area VC deals in Q2 2022 include software company Remote Technology Inc. ($300 million), sales and payments software company SpotOn Transact Inc. ($300 million), and gene-based treatment startup Kriya Therapeutics Inc. ($270 million).

The New York metro and Greater Boston areas are also established tech centers with a history of relatively high VC investment. Los Angeles is also burgeoning into a major tech hub with rising focus on media and entertainment tech.

ScOp

US investments concentrated in top cities

Venture capital investment in top 10 areas vs US at large

Nearly 82% of U.S. venture capital in H1 2022 was invested in the top 10 markets. That figure has been in the low 80s since 2014. Before that, it had mainly hovered around the low-to mid-70s since PitchBook began publishing data in 2006.

Deal concentration has heightened in top markets compared to historical figures. The Bay Area’s share was 22% in 1995, increasing to 36% in 2022 so far. The New York metro area grew its share from 3% in 1995 to nearly 14% today. This makes evident that tech isn’t yet spreading out as much as some predicted it might in an age of increased virtual meetings and remote work.

ScOp

Change in investments from last year

Investment change from H1 2021 to H1 2022 in top 10 regions

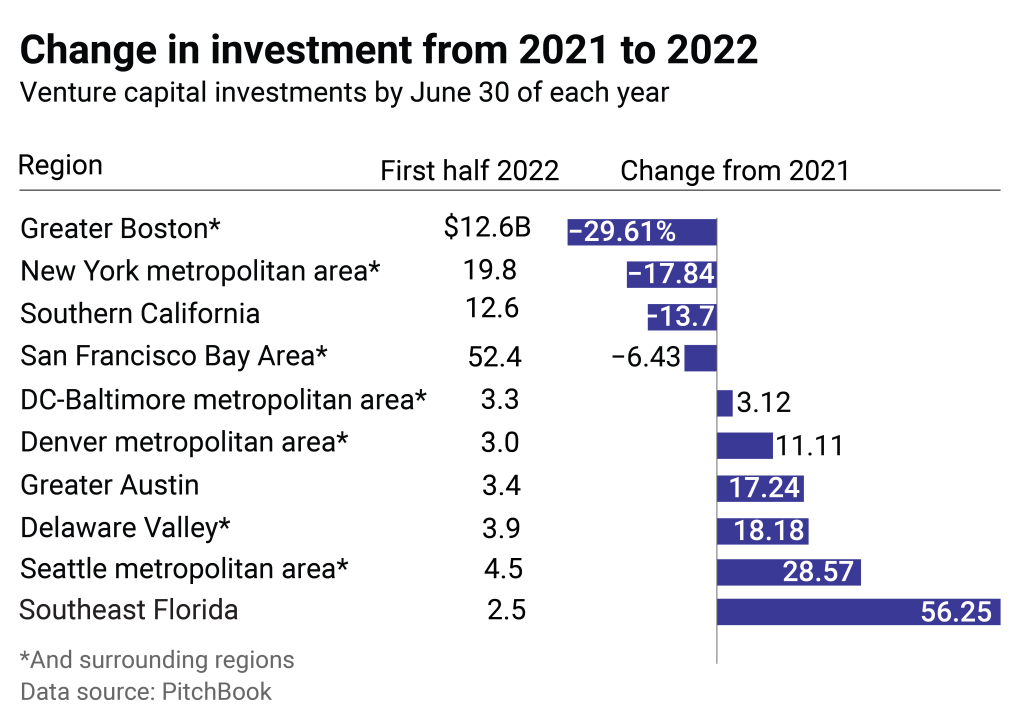

In some cities, VC investment actually increased in H1 2022 compared to the same time last year. The four biggest markets all saw VC decreases, but the rest of the top 10 had gains in VC investment.

The largest percent increase occurred in the Southeast Florida region, which grew from $1.6 billion to $2.5 billion. Crypto, blockchain, and Web3 startups drew the most investment in Miami. Close to $1 billion of Florida funds raised were in three mega-rounds, or those greater than $100 million. There was also a mix of funding rounds by companies that were founded in South Florida, and those that recently moved to the area.

The Seattle metro area had the next-highest increase, with startups growing investments from $3.5 billion to $4.5 billion. This combined statistical area is the fifth largest for VC investments in 2022 so far. The Seattle metro region is headquarters to tech leaders including Amazon and Microsoft and serves as a major hub for the likes of Meta, Google, Apple, and others. The hub is known more broadly for its cloud computing expertise. Major local investors include Madrona Venture Group, M12 (formerly Microsoft Ventures), and PSL Ventures—a branch of startup studio Pioneer Square Labs.

This story originally appeared on ScOp and was produced and

distributed in partnership with Stacker Studio.