Man told by state to pay $8,000 tax bill on unemployment benefits he never received

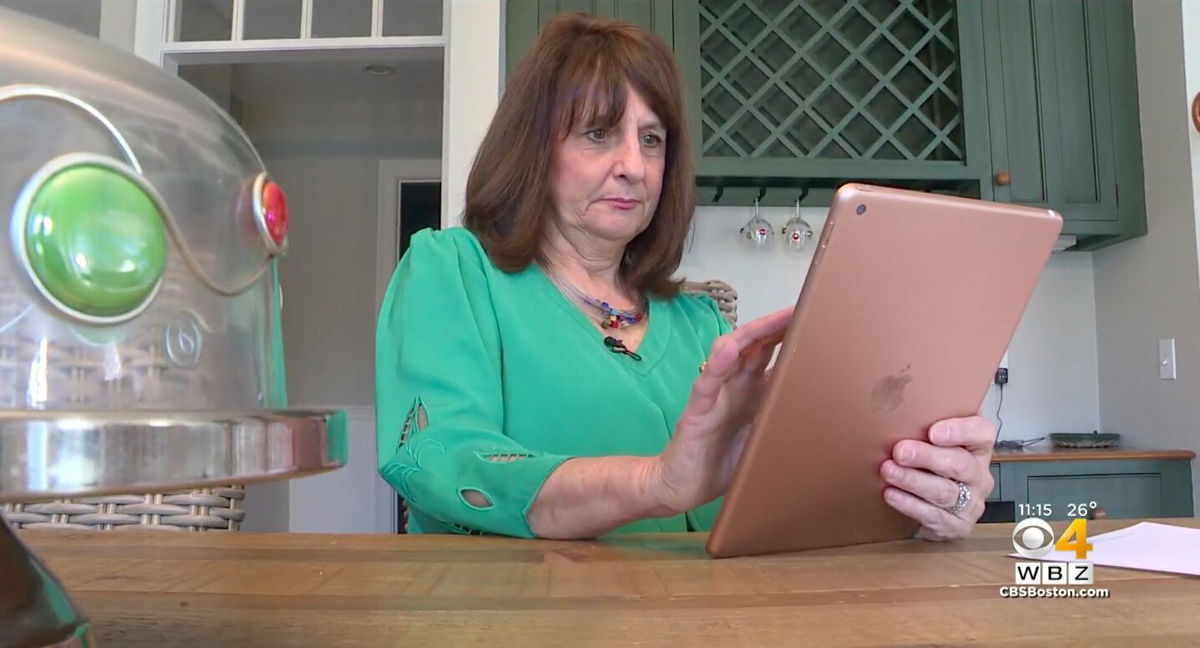

Linda Kearns says her husband received a 1099-G form in the mail claiming he owed taxes on $22

By Anaridis Rodriguez

Click here for updates on this story

HANOVER, Massachusetts (WBZ) — Pandemic unemployment fraud has been a huge issue across the nation, but a Hanover couple had no idea they were caught up in the mess until they received a tax form for benefits they never received or applied for.

Linda Kearns says her husband received a 1099-G form in the mail claiming he owed taxes on $22,000 in unemployment payments. “He never collected a penny of unemployment in his entire 40-year career,” she said.

Linda and her husband immediately appealed. The Department of Unemployment Assistance sent back a letter saying an investigation was completed and the form was accurate. “We have to pay taxes on that money to the IRS to the tune of $8,000,” Linda said as she read from the letter saying they could dispute that tax payment with the IRS. “Good luck with that,” she said.

Tax accountants agree with that. In order to dispute that payment, the Kearns would have to pay the money and then file a 1040-X amended form and try to get the money back from the IRS. Hingham tax accountant Tim MacLellan says the IRS is backed up in processing 1040-X forms and they could be out that money for a long time. “At least a year,” he said.

We encouraged Linda to reach out to her state senator who contacted her immediately. “If I got a letter like this I would probably be in shock or probably have a heart attack,” said Senator Michael Brady only half-jokingly.

Brady told us he got in touch with the Department of Unemployment Assistance, and they agreed to send the couple a new form that would correct the problem.

What is most troubling to Linda is the fact that her husband’s company sent documents to the state months ago saying her husband was still employed and the claim was fraudulent. “I don’t think they even did an investigation. They basically washed their hands of it and now want to put it on the IRS which means a lot of work on our end to get this rectified,” she said.

The State Department of Unemployment Assistance provided the following statement on the process of investigating fraudulent claims:

Taxpayers are not required to pay taxes on money they never received. However, once benefits have been paid, DUA has to investigate the matter to confirm the actual recipient. The DUA Program Integrity team will process the reported fraud to ensure that if any payments were made, they are not recognized as income, and are not reported to the IRS on Form 1099-G at the end of the calendar year for tax purposes. If a constituent receives a 1099-G related to this fraudulent claim, DUA will, upon being notified, send a corrected Form 1099-G. In addition, the fraudulent claim will not impact a constituent’s ability to collect unemployment in the future and no charges will be assessed to the constituent’s employer (if applicable).

If DUA reviews a claim, and determines that the 1099-G was properly issued, and the constituent disagrees, the matter must then be addressed by the constituent directly to the IRS.

Please note: This content carries a strict local market embargo. If you share the same market as the contributor of this article, you may not use it on any platform.