Countries with the lowest income inequality

Lena Ivanova // Shutterstock

Countries with the lowest income inequality

Income inequality, which refers to how uneven income is distributed among a population, is no small problem today: The United Nations says 71% of people across the globe live in countries where this kind of inequality has risen. Still, some societies have become more equal than others, and to demonstrate this, Stacker used data from the World Inequality Database to compile a list of 30 countries with the lowest income inequality. This measure is based on the lowest share of pre-tax income earned by the top 1% (i.e., the individuals in the top 1% earn a salary closest to what individuals would earn if there was “perfect income equality”), with ties broken by the share of income held by the bottom 50%.

To help put the share of pre-tax income earned by the top 1% and bottom 50% in perspective, we considered “perfect income equality,” in which every individual adult would earn the same income. In a country with perfect income equality, for example, the top 1% would earn exactly 1% of all income, and the bottom 50% would earn exactly 50% of all income.

While many nations are getting closer to perfect income equality, none have achieved this yet. The United States, for instance, has a long way to go: It’s the 52nd country with the most income inequality in the world based on this ranking. Even when income distribution appears relatively even, inequities of opportunity still abound and can ultimately impact economic circumstances in personal and collective ways.

Read on to see which countries have more equal societies, the factors that contribute to that outcome, and some of the disparities that still exist.

You may also like: Most lopsided state legislatures in America

![]()

Slavica Stajic // Shutterstock

#30. Serbia

– Share of pre-tax income earned by the top 1%: 10.9%

— 9.9% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 17.8%

— 32.3% less than perfect income equality

Unemployment is high in this Balkan country, and many who do work receive wages that are lower than the national average. So many Serbians leave the country to find better opportunities that the government has said it’s “effectively losing a town each year.” Remittances from people who send money back home help reduce poverty rates and so can government benefits, but about one in five Serbians still faced the risk of poverty in 2020.

Eric Valenne geostory // Shutterstock

#29. Mauritania

– Share of pre-tax income earned by the top 1%: 10.8%

— 9.8% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 16.8%

— 33.2% less than perfect income equality

Mauritania, a largely desert nation in West Africa, is one of the least densely populated countries on the globe. Most of the population relies on subsistence agriculture and livestock, but their economic circumstances are made all the more difficult by recurring droughts, political instability, and bad governance. (The country’s former president was arrested in June 2021 for suspected corruption while in office.) While social assistance spending is one of the highest in its region, more than 20% of people live in poverty.

TTstudio // Shutterstock

#28. Greece

– Share of pre-tax income earned by the top 1%: 10.7%

— 9.7% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 21.0%

— 29.0% less than perfect income equality

Greece’s reforms of its social welfare system, which include a guaranteed minimum income benefit, and improvements in the labor market have helped reduce income inequality. Nonetheless, Greece’s poverty rate is among the highest in the European Union, and women and households with children are among the most vulnerable. Even more, the country still has high unemployment, especially among the youth.

JackKPhoto // Shutterstock

#27. Luxembourg

– Share of pre-tax income earned by the top 1%: 10.4%

— 9.4% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 20.2%

— 29.8% less than perfect income equality

Social benefits help close gaps in income and reduce poverty in this European country, which is the wealthiest nation in the world, based on the gross domestic product (GDP) per capita in 2021. A less desirable distinction is that Luxembourg has one of the highest levels of in-work poverty in the European Union. Non-EU employees are more likely to find themselves working but poor compared to natives.

Finn stock // Shutterstock

#26. Finland

– Share of pre-tax income earned by the top 1%: 10.3%

— 9.3% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 21.7%

— 28.3% less than perfect income equality

The Nordic welfare state helps level incomes through a healthy social protection program that includes benefits for unemployment, sickness, and disability. Still, not everything’s egalitarian in the place that a UN initiative has consistently described the happiest country in the world. “The general level of health and wellbeing of Finns has improved continuously,” the Finnish Institute for Health and Welfare says, “but the distribution of health and wellbeing among the population is becoming increasingly unequal.”

You may also like: Most dangerous countries for journalists

concept w // Shutterstock

#25. Croatia

– Share of pre-tax income earned by the top 1%: 10.2%

— 9.2% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 18.4%

— 31.6% less than perfect income equality

Croatia’s economy is among the weakest in the European Union, and for a country that relies so heavily on tourism, the economic pain of the COVID-19 disruption has been collectively shared. Nearly 30% of Croatian households reported an annual reduction in overall income in 2020. Social assistance programs help reduce poverty and inequality in this country, where many of its citizens are seeking prosperity outside its borders.

MEDIAIMAG // Shutterstock

#24. Austria

– Share of pre-tax income earned by the top 1%: 10.1%

— 9.1% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 22.0%

— 28.0% less than perfect income equality

Austria’s tax-benefit system is instrumental in reducing income inequality, and the government offers free education, public transportation, and publicly funded health care. Though it’s one of the wealthiest of all the lands, poverty is still a scourge. More women suffer from poverty than men, and the employment-based welfare system puts migrants at higher risk as well.

DaLiu // Shutterstock

#23. Czech Republic

– Share of pre-tax income earned by the top 1%: 10.0%

— 9.0% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 25.5%

— 24.5% less than perfect income equality

The tax-benefit system of this country, which also goes by the name Czechia, helps minimize income disparities. However, homelessness is a serious concern, and most of the afflicted are “roofless” due to a problem the country is actively addressing: indebtedness. There are also regional differences in GDP per capita, and those who face a higher risk of poverty include people with disabilities and Roma communities.

ambient_pix // Shutterstock

#22. Algeria

– Share of pre-tax income earned by the top 1%: 9.9%

— 8.9% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 19.0%

— 31.0% less than perfect income equality

Many rely on redistributive social policies in this nation, which is rich in oil and gas. Reuters reports revenues from those resources actually account for 60% of Algeria’s state budget and 94% of total sales abroad. That lack of economic diversification is catastrophic when prices drop. Among the other challenges facing Algerians is a dismally high rate of youth unemployment.

karp5 // Shutterstock

#21. Belarus

– Share of pre-tax income earned by the top 1%: 9.9%

— 8.9% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 22.5%

— 27.5% less than perfect income equality

Fiscal policies with a high equalizing effect contain income inequality and poverty in this former Soviet republic. Another contributor: key sectors are state-run. However, while the entire country experiences life under a repressive regime run by Alexander Lukashenko, who is often referred to as the “last dictator in Europe,” there is an uneven distribution of economic opportunities across Belarusian regions.

You may also like: 25 terms you should know to understand the gun control debate

Marc Bruxelle // Shutterstock

#20. France

– Share of pre-tax income earned by the top 1%: 9.9%

— 8.9% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 22.7%

— 27.3% less than perfect income equality

High personal income taxes help pay for social welfare benefits that largely enable France to uphold the economic interpretation of its “liberty, equality, fraternity” motto. Nonetheless, high unemployment is a problem—especially for people with migrant backgrounds—and financial frustrations were a root cause of the 2018 Yellow Vest protests.

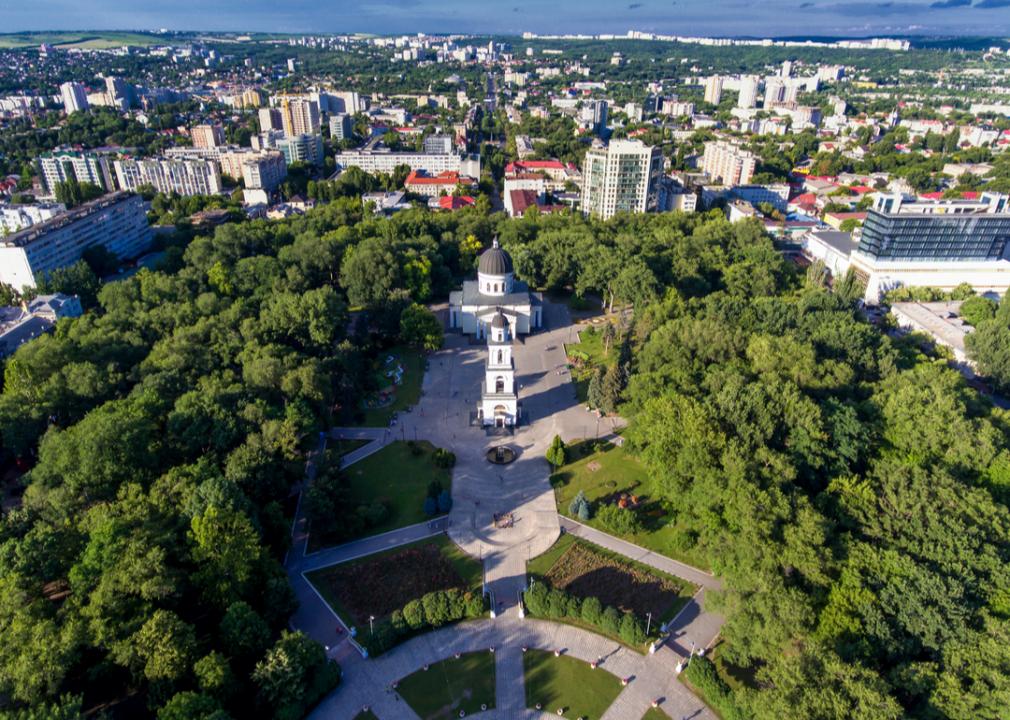

Calin Stan // Shutterstock

#19. Moldova

– Share of pre-tax income earned by the top 1%: 9.9%

— 8.9% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 18.2%

— 31.8% less than perfect income equality

This former Soviet republic is among the poorest countries in Europe. Social assistance and pensions help many lower-income residents get by, but critics say spending is inadequate and leaves families with multiple children vulnerable to poverty. Personal remittances from Moldovans who have sought work elsewhere also help those back home—in fact, remittances accounted for about 15% of GDP in 2020.

hbpro // Shutterstock

#18. Montenegro

– Share of pre-tax income earned by the top 1%: 9.8%

— 8.8% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 16.4%

— 33.6% less than perfect income equality

Increases in social assistance and wage boost in the public sector could be behind the income growth and poverty reduction in this country that gained its independence in 2006. Still, poverty remains a problem, especially for Roma and Egyptian populations. In addition, the country’s northern region has a significantly higher risk of poverty than its central region, and the risk is also much higher for residents in rural areas than urban ones.

Thomas Brissiaud // Shutterstock

#17. Mali

– Share of pre-tax income earned by the top 1%: 9.7%

— 8.7% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 16.3%

— 33.7% less than perfect income equality

Residents of this West African country live with political instability, a high poverty rate, and a low-income, undiversified economy largely dependent on fishing and farming. Most of Mali’s poorest live in the densely populated rural areas in the south, and an estimated 78% of Malians are not covered by a social safety net. The income inequality that is present in the country largely exists in urban areas.

Lena Ivanova // Shutterstock

#16. Sweden

– Share of pre-tax income earned by the top 1%: 9.5%

— 8.5% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 24.3%

— 25.7% less than perfect income equality

High personal income taxes and social benefits are integral to creating economic balance in this Scandinavian country. Among the generous benefits are 480 days of paid parental leave when a child is born or adopted and tax-subsidized health care. One aspect that can affect career mobility is the challenge of finding affordable housing in big cities; it especially impacts young residents, low-income groups, and new migrants.

You may also like: LGBTQ+ history before Stonewall

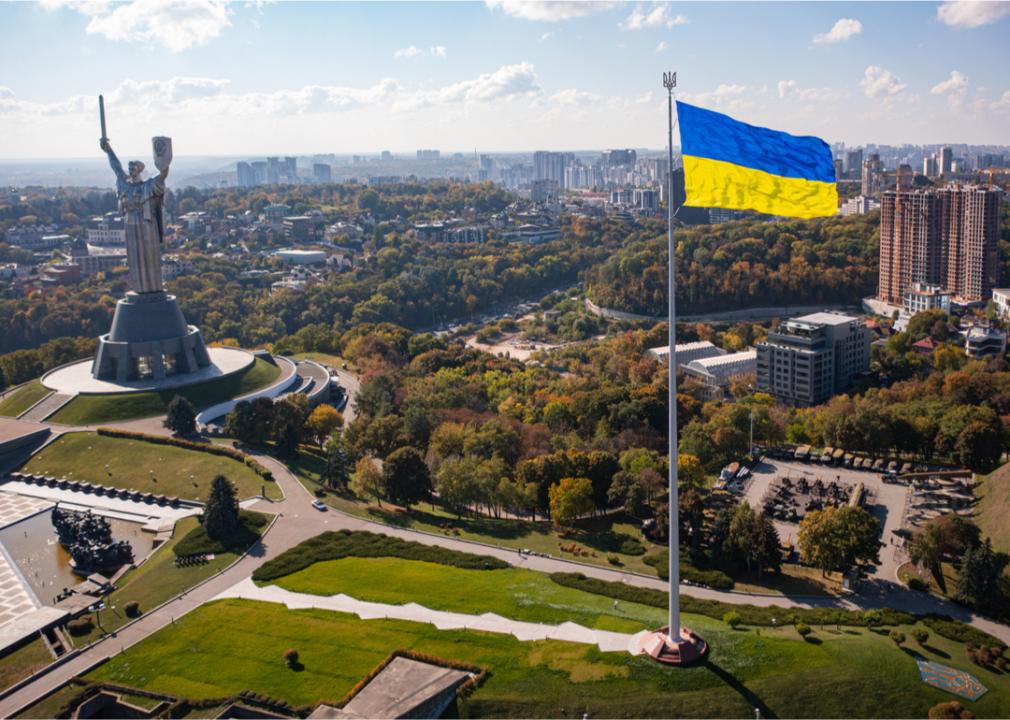

Ruslan Lytvyn // Shutterstock

#15. Ukraine

– Share of pre-tax income earned by the top 1%: 9.5%

— 8.5% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 22.6%

— 27.4% less than perfect income equality

Although this post-Soviet state is one of the world’s top producers of grain crops like wheat, corn, and barley, it is among the poorest countries in Europe. Russian aggression creates challenges for the economy, and so does corruption. Officials estimate a third or more of the economy operated in the shadows in 2020, outside of regulation and taxation. Meanwhile, Ukrainians can’t rely on social protection, as the United Nations says, “Support to low income and vulnerable households is inadequate, difficult to access and remains fragmented.”

Patryk Kosmider // Shutterstock

#14. Malta

– Share of pre-tax income earned by the top 1%: 9.4%

— 8.4% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 20.4%

— 29.6% less than perfect income equality

The welfare system of the smallest country in the European Union mitigates inequality, and strong economic growth and job creation have helped reduce poverty. However, the island nation has one of the highest gender employment gaps in the EU.

Kiev.Victor // Shutterstock

#13. Norway

– Share of pre-tax income earned by the top 1%: 9.3%

— 8.3% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 24.6%

— 25.4% less than perfect income equality

Social benefits help level economic inequities in this Scandinavian welfare state. Policy proposals to stem the economic disparities that still exist helped propel Jonas Gahr Støre’s Labour Party to victory in the recent national election. Poverty is low but rising, and immigrants are among the vulnerable.

Alex Tihonovs // Shutterstock

#12. Latvia

– Share of pre-tax income earned by the top 1%: 9.1%

— 8.1% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 18.0%

— 32.0% less than perfect income equality

Taxes and social assistance, including a guaranteed minimum income benefit, help redistribute income in this Baltic nation. However, Latvia still has one of the highest levels of income disparity among European Union members and the most pensioners at risk of experiencing poverty. Critics say the tax system isn’t progressive enough and the safety net needs to be strengthened.

Lev Levin // Shutterstock

#11. Albania

– Share of pre-tax income earned by the top 1%: 9.0%

— 8.0% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 18.9%

— 31.1% less than perfect income equality

Albania is one of the poorest countries in Europe. In fact, the World Bank estimates nearly a third of the population of this former communist country in 2021 lived in poverty. Fiscal policy, especially public spending on health and education, helps shrink income inequality.

You may also like: Oldest cities in America

Shyshko Oleksandr // Shutterstock

#10. Bosnia and Herzegovina

– Share of pre-tax income earned by the top 1%: 9.0%

— 8.0% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 18.2%

— 31.8% less than perfect income equality

The troubles of this Balkan nation didn’t disappear when its civil war ended more than 25 years ago. Earned income was the main source of income for fewer than 30% of households in 2019, according to the United Nations Development Programme, and pensions were the main source for another 30%. An under-resourced social assistance program helps mitigate inequality but doesn’t always offer sufficient coverage for those who need the most help, and employment discrimination forces most of the Roma population to work in the shadow economy.

Xinovap // Shutterstock

#9. Sao Tome and Principe

– Share of pre-tax income earned by the top 1%: 9.0%

— 8.0% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 17.5%

— 32.5% less than perfect income equality

This Portuguese-speaking, small island nation off the west coast of Africa is taking important steps to strengthen economic prosperity but remains among the least developed countries in the world. An estimated 90% or more of its budget is financed by foreign donors including the World Bank and European Union. More than two-thirds of the population is considered poor, according to the World Bank, and about one-third are even worse off, living on less than the international poverty line. Poverty is higher in urban areas and southern districts of the country.

Kristi Blokhin // Shutterstock

#8. Italy

– Share of pre-tax income earned by the top 1%: 8.9%

— 7.9% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 20.6%

— 29.5% less than perfect income equality

Italy’s tax and benefit system helps control income inequality, though its levels are among the highest in the European Union and have been on the rise in recent years. There are pronounced regional economic gaps as well, with higher unemployment in the South. In addition, many Italian women find it hard to enter the job market; if they succeed, they often get paid less than their male peers in the private sector.

Boyloso // Shutterstock

#7. Iceland

– Share of pre-tax income earned by the top 1%: 8.8%

— 7.8% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 25.0%

— 25.0% less than perfect income equality

High labor force participation of men and women, a compressed wage distribution, and an effective social welfare system help reduce inequality in Iceland. Yet, even in this island nation that the World Economic Forum has consistently described as the most gender-equal country in the world, and that implemented a pioneering pay equity law in 2018, a gender pay gap still exists.

K.choktravel // Shutterstock

#6. Kosovo

– Share of pre-tax income earned by the top 1%: 8.7%

— 7.7% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 18.4%

— 31.7% less than perfect income equality

Although the country that declared independence from Serbia in 2008 has seen inclusive economic growth in recent years, it’s still one of the poorest in Europe. Among the issues that are alive and well: corruption, political instability, a significant informal economy, high long-term unemployment, slow job creation, and widespread poverty that is more acute in rural areas.

You may also like: Political Cartoons From The Last 100 Years

Anton_Ivanov // Shutterstock

#5. Belgium

– Share of pre-tax income earned by the top 1%: 8.6%

— 7.6% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 20.4%

— 29.6% less than perfect income equality

A strong tax and benefit system, as well as a middle class, help reduce inequality in this country, where 98% of residents live in urban areas. Still, the share of low-wage workers jumped from 3.8% to 13.7% between 2014 and 2018. The poverty risk is higher for people with little education and those who aren’t born in the European Union.

RossHelen // Shutterstock

#4. Slovenia

– Share of pre-tax income earned by the top 1%: 8.0%

— 7.0% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 23.1%

— 26.9% less than perfect income equality

After gaining its independence from Yugoslavia in 1991, a researcher explained, Slovenia “institutionalized many rights of workers and created its own unique variety of capitalism which has ensured almost socialist levels of income inequality even today.” Sickness and disability benefits help reduce poverty, but women over 65 are among the most at risk.

Peter Hanzes // Shutterstock

#3. Slovakia

– Share of pre-tax income earned by the top 1%: 7.4%

— 6.4% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 24.4%

— 25.6% less than perfect income equality

Slovakia’s low variation in wages plays a big role in reducing its income inequality. While poverty is low overall in this European Union country with a growing economy, it is prevalent among the Roma population.

Yasonya // Shutterstock

#2. Netherlands

– Share of pre-tax income earned by the top 1%: 6.9%

— 5.9% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 22.5%

— 27.5% less than perfect income equality

Income equality comes at a high cost for the Dutch, especially those who faced a personal income tax rate of 49.5% in 2020. Yet, in addition to the highly redistributive tax and benefit system, other mitigating factors that make the European nation more egalitarian include free public education, strong labor protection laws and universal health care. While poverty is low, residents not born in the European Union are at higher risk.

Erik Cox Photography // Shutterstock

#1. North Macedonia

– Share of pre-tax income earned by the top 1%: 6.6%

— 5.6% more than perfect income equality

– Share of pre-tax income earned by the bottom 50%: 20.9%

— 29.1% less than perfect income equality

Social benefits are helping this developing Balkan country formerly known as Macedonia keep income inequality low. Remittances play a role as well. The country is believed to have a large informal economy—the kind of work that doesn’t get reported or taxed—and a high poverty rate of those who work in it. As in many other countries, poorer citizens face inequities including access to good jobs, health care, and education.

You may also like: How America has changed since the first Census in 1790